$10,000 Dividend Investment Portfolio

You have $10,000 and you want to know what kind of dividend investment portfolio you should build with it. You want to know which stocks to buy that will give you a good return on your investment. Luckily for you there are many fantastic stocks to choose from that will give you just that. I have selected six stocks that if I had ten grand dropped into my lap that I would put this money into.

Table of Contents

Company Basics

| (JEPQ) JPMORGAN NASDAQ EQUITY PREMIUM INCOME ETF $46.54 per share 11.80% Div Yield $0.417190 per month (estimated) | (KO) COCA-COLA CO $52.38 per share 3.34% Div Yield $0.46 per month |

| (MMM) 3M CO $87.83 per share 6.82% Div Yield $1.50 per quarter | (MO) ALTRIA GROUP INC $41.99 per share 9.41% Div Yield $0.98 per quarter |

| (O) REALTY INCOME CORP $50.06 per share 6.20% Div Yield $0.256 per month | (BEN) FRANKLIN RESOURCES INC $23.90 per share 5.06% Div Yield $0.30 per quarter |

Portfolio Breakdown

- 200 shares

- $9,995.50 Portfolio Value

- $709.82 Yearly Dividends

| (JEPQ) JPMORGAN NASDAQ EQUITY PREMIUM INCOME ETF | 35 shares $192.21 Yearly (Est.) |

| (KO) COCA-COLA CO | 35 shares $59.95 Yearly (Est.) |

| (MMM) 3M CO | 30 shares $178.91 Yearly (Est.) |

| (MO) ALTRIA GROUP INC | 40 shares $151.67 Yearly (Est.) |

| (O) REALTY INCOME CORP | 30 shares $91.16 Yearly (Est.) |

| (BEN) FRANKLIN RESOURCES INC | 30 shares $35.92 Yearly (Est.) |

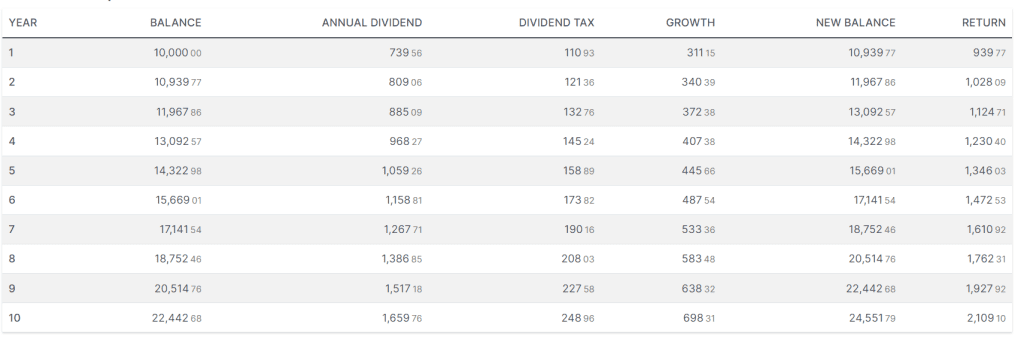

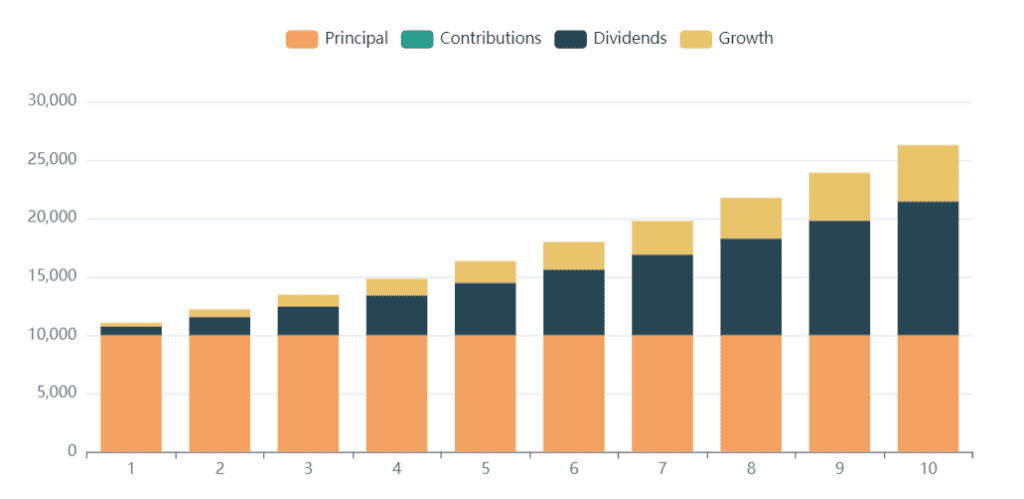

10-Year Portfolio Infographics

If you decide to leave this investment alone, after ten years of compound interest (10% AROI), you will be left with $24,551.79. Not bad for a $10,000 investment. This portfolio is safe and all of the companies you see here have been paying out dividends for more than 25 years.

Yearly Breakdown