How Do Taxes Work When It Comes To Stocks?

Do you remember when you got your first job and you could not wait for your first paycheck. Payday comes and you are excited thinking about all the things you want to buy but you notice something is wrong. Your paycheck looks small and your excitement turns to sadness because you realize you have to pay taxes now. The government takes their cut and you are left with the rest. The same thing happens to stocks. You will pay a tax on stocks. You are probably asking yourself, “How do taxes work when it comes to stocks?” Allow me to teach you!

Table of Contents

Disclaimer – I am not a licensed financial planner, lawyer, tax adviser or stockbroker. I am simply a person who loves to invest.

If you are new to investing, you may also be new to understanding taxes on investments. When thinking about how stocks are taxed, capital gains come to the minds of many. However, taxation of stock can also include dividends. We will cover both concepts so you know what to expect as you invest.

Understanding capital gains vs. dividends

Before we begin, you can avoid many taxes by using a Roth IRA for your investments. Check out the article I wrote HERE.

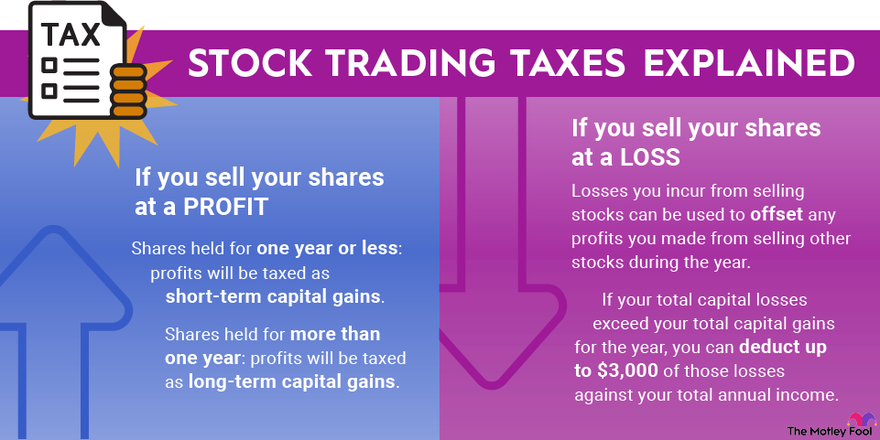

When the share price goes up and down, it affects your taxes. If you made a profit or a loss, this will shift the scale on what you owe, if you owe anything at all. The duration of how long you held the stock will also affect this.

Capital gains tax

When you buy and sell stocks, you will pay what is called a capital gains tax. When it comes to investing, you are told to buy low and sell high. This is fine and dandy but this triggers the capital gains tax I just mentioned. For example, if you buy a stock for $5, it rises to $10, and you decide to sell, you will pay a tax on the $5 profit you made. The tax rate depends on the length of time you hold the stock before selling it.

Let us discuss the different types of gain tax you will incur when selling your shares of a company. We have short-term capital gains tax and a long-term capital gains tax. This will affect all your stocks, including your dividend stocks for all my dividend investors out there.

Short-term capital gain: This occurs when you sell a stock you owned for one year or less. You are taxed on this type of gain depending on your ordinary income tax rates.

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

Long-term capital gain: This occurs if you owned a stock longer than a year before selling. You are taxed at the following rates, depending on your taxable income:

- 0%

- 15%

- 20%

Capital loss

When you sell, a stock for less than what you bought it for, you will receive a capital loss. This helpful later when doing your taxes. For example, let us say you bought $4,000 worth of stock this year. At the end of the year, you realize your investments are not paying off and decide to walk away. You sell the stocks but now you only get $2,000 back. You took a loss of $2,000 and you can claim this on your taxes.

Dividend stocks

When using the dividend investing strategy, you need to account for taxes. Using a Roth IRA will help with this. Check out the link to learn more. Dividends paid to you monthly, quarterly, or annually is considered income by the government.

Dividend stocks can be taxed differently and sometimes not at all. You have Nonqualified dividends which include dividends paid out by foreign companies and some U.S. businesses. These are taxed at an ordinary rate using the standard income tax bracket.

Qualified dividends are dividends that are paid by a U.S. company or a foreign company that trades in the U.S. or has a tax treaty with the U.S. In addition, you must own the stock for a specific period. They are taxed at 0%, 15%, and 20%.

Net investment income tax

If you are a high-income earner, you will want to be aware of net investment income tax. This applies to certain income from investments. The tax rate is 3.8% and it applies to your modified adjusted gross income (MAGI).

$125,000 for those with the Married Filing Separately status

$200,000 for those with the Single or Head of Household status

$250,000 for those with the Married Filing Jointly or Qualifying Surviving Spouse status

You should use Form 8960 if you have to pay net investment income tax.

Get Financial Help

It is very important to consult a licensed tax professional so you can avoid tax issues with the government. The government has plenty of time on their hands and they will spot errors and come down hard. Please avoid the mistakes and consult a tax expert.