What is Debt Consolidation and How can It Benefit You?

What is Debt Consolidation? If you were like me during covid, you racked up a lot of debt trying to stay alive. Simply living was costing an arm and a leg and you find yourself trying to figure a way out. You need help and that is ok. I needed help and at moments, I felt too embarrassed to ask or seek it out. You have probably heard someone mention it before so you go to google and ask, “What is debt consolidation?”

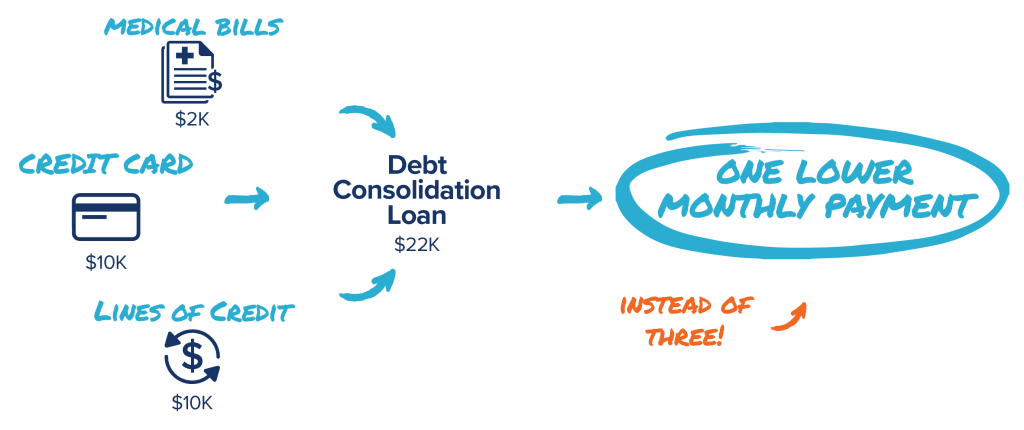

Debt consolidation is a program that will help you combined all your debts into a single loan, usually with a lower interest rate. This can be a very useful tool for people who are struggling to tackle their debt.

Table of Contents

How Does Debt Consolidation Work?

The program works by taking out a new loan to pay off existing debts that you may have. The loan will usually have a lower interest rate, which will help you out in lower monthly payments. The reduced payment per month can help you save money each month and that adds up over time. By reducing the amount of debt into one single loan, you simplify your finances and allows you to focus on one payment per month instead of many.

There are different ways to consolidate debt, including:

Personal Loans: The most common way people consolidate their debt is by taking out a loan at their local bank, credit union or online lender. With this kind of loan, the institution that gives you the loan will require that it go towards debt and might require proof of it. In addition, be careful of online lenders as they might charge a higher interest rate for a loan. Some lenders pray on people so please do your own research.

Balance Transfer: I do not recommend transferring one debt for another, unless you get a decent loan but this is an option you can pursue. You can transfer your high-interest credit card debt to another card with a lower interest rate. I would consider a personal loan first before trying this option.

Home Equity Loan or Line of Credit: If you are fortunate enough to own a home, you can use the equity in your home to qualify for a loan. This option can be very attractive, as these kinds of loans tend to have a lower interest rate.

Benefits of Debt Consolidation

Debt Consolidation has many benefits that can help you regain your financial freedom and security. Some benefits include:

Simplified Repayment: The program gives you the ability to have one loan payment instead of many. This will help you keep track of your finances and give you some breathing room. I remember when I went into the program; I was able to save roughly $400 each month.

Lower Interest Rates: Interests rate are generally lower for these kinds of loans. The purpose of the loan is to help you recover and regain control over your finances. Having a lower interest rate benefits the institution giving out the loan because they want you to succeed. If you succeed, they are paid; it is a win-win.

Potential to Improve Credit Score: Making on-time payments to a loan will help increase your credit score. This can have long-term benefits, especially if you would like to own a home someday or get a loan for a vehicle. Having good credit benefits you greatly. In addition, future loans will have better interest rates.

Drawbacks of Debt Consolidation

I have gone over the positives for this kind of program, but let us discuss the negatives. While it can be beneficial, let us consider the potential drawbacks before you make any financial decisions. These drawbacks include:

Extended Repayment Period: By utilizing this kind of program, you will have a loan that will take some time to pay back. This can result in paying more in interest over the life of the loan. However, most loans offer an early repayment option if you can afford to pay more during certain months.

Risk of Accruing New Debt: Once your debts are consolidated, it’s important to avoid taking on new debt. Some individuals may be tempted to use their newly available credit, which can lead to further financial difficulties.

Fees and Costs: Depending on the method of consolidation you choose, there may be fees and costs involved, such as origination fees or balance transfer fees. Be sure to factor these into your decision-making process.

Is Debt Consolidation Right for You?

Determining if debt consolidation is the right option for you depends on your individual financial situation and goals. Here are a few factors to consider:

Level of Debt: If you have multiple high-interest debts and are struggling to keep up with payments, debt consolidation can provide relief and simplify your repayment process.

Interest Rates: Compare the interest rates of your current debts to the rates available for consolidation. If you can secure a lower rate, debt consolidation may be a smart choice.

Financial Discipline: It’s crucial to assess your spending habits and financial discipline. Debt consolidation is most effective when coupled with a commitment to responsible financial management.

Debt consolidation can be an effective strategy to manage and simplify your debts. By combining multiple debts into one loan, individuals can benefit from lower interest rates, simplified repayment, and potential credit score improvement. However, it’s important to consider the potential drawbacks and assess your personal financial situation before deciding if debt consolidation is the right choice for you. Consulting with a financial advisor can also provide valuable insights and guidance tailored to your specific needs.