What is a Stock Split?

Have you ever wondered what is a stock split? You have probably read it once or twice when researching companies to invest. How does it affect the value of a company? Why do companies do this? What is the point of it all? I am here to answer all those questions. Check out the article and I hope you enjoy. So, let us dive right in!

Table of Contents

Understanding Stock Splits

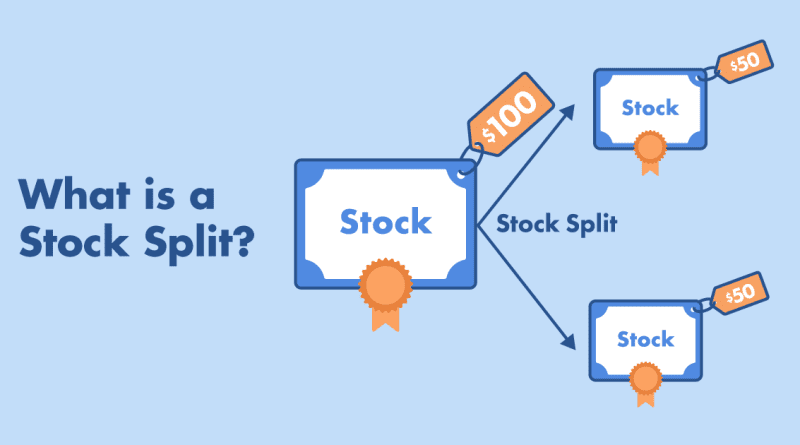

A stock split is when a company decides to well, split their stock. It basically divides shares into new shares, either reducing the amount or adding to the amount. The split can vary depending on what the company in question is trying to achieve. For example, a common split is 2-for-1-split. This means that for every share an investor holds, they will receive an additional share. The overall value of their investment remains the same, but the number of shares they own doubles.

There are also reverse stock splits which will do the opposite. This means, a company might have 2 million shares and decide they want 1 million shares. By doing this, the value of the share will rise for new investors but your value will remain the same. You might have 10 shares of a company and after the reverse split you end up with 5. The value of those 10 will remain for the 5 you get after.

Why Do Companies Split Their Stock?

A company decides on a new direction or they are trying to gather more investors. If you have a million shares and almost all of them are owned by investors, new funding is hard to get. If you do a stock split and add shares, now you have more the chance more investors will buy. This increased demand can potentially drive up the stock’s value in the long run.

Moreover, a stock split can also enhance a company’s liquidity. With a larger number of shares available for trading, there is generally increased trading activity, allowing investors to buy and sell shares more easily.

Let us use the example above with the 2-for-1-split. Let us say Microsoft is selling for $100. That price means that Microsoft is being priced by the market for $100 times all the shares of Microsoft are out there.

Microsoft has a few billion in shares that investors own, but for this example we will say it is a billion shares total. This means that Microsoft has $100 billion in shares.

Microsoft will announce to the world that they will be doing a stock split. On the day of the split, the company will issue two new shares for each share already owned or in circulation for one of their old shares. This means, the company no longer has 1 billion shares, but 2 billion now. Nothing major happened; the only thing that changed is that Microsoft now has 2 billion shares instead of 1 billion.

You are probably wondering if that changed the value of the stock. Yes and no. Your value of the stock has not changed, however, the trading price has. You still only $100 worth of Microsoft but to a new investor, they are paying $50 per share instead of $100 the day before. I hope that my example makes sense.

The Impact on Share Price and Market Capitalization

As mentioned above, the stock split does not directly affect the company’s market capitalization. The split however can fuel a surge in new investors, which over time would raise its value and the value of shares you own.

Stock Splits Can be Deceiving

Not every stock split is a good one and companies sometimes do this to deceive new investors. Let us say you have been eyeing a particular company and you have been waiting for a good price. You check one day and suddenly the price of that stock is half of what it used to be and this makes you happy as can be. You begin buying shares left and right because you think you are getting a good deal.

However, when this happens, you think you are getting a good deal but you could be spending more money on a stock than you would before the split. In reality, the new lower price of a company’s stock after it undergoes a stock split has nothing to do with its true value. In addition, some companies will do a stock split to keep their share price above $1. Why $1? Most brokerage firms require that a stock trade above $1 to remain listed. If not, they run the risk of being delisted.

Conclusion

In summary, a stock split occurs when a company divides its existing shares into multiples. This action is done to make the shares more affordable and accessible to a wider range of investors. While a stock split may initially affect the share price, it does not directly affect the total market value of the company’s shares. Understanding the implications of a stock split is essential for investors seeking to make informed decisions.