5 Dividend Stocks For Beginners

New to investing? No problem, I am here to help. You want to know which stocks are safe to buy and will earn you money in the process. There are a variety of stocks that will do this for me, but I have handpicked five that I think will set you on the right path. These are solid companies with a solid financial history. Their dividend history is also solid which makes them the perfect starter set. Without holding you back any further, let us dive into it.

Sponsor

Table of Contents

Johnson & Johnson

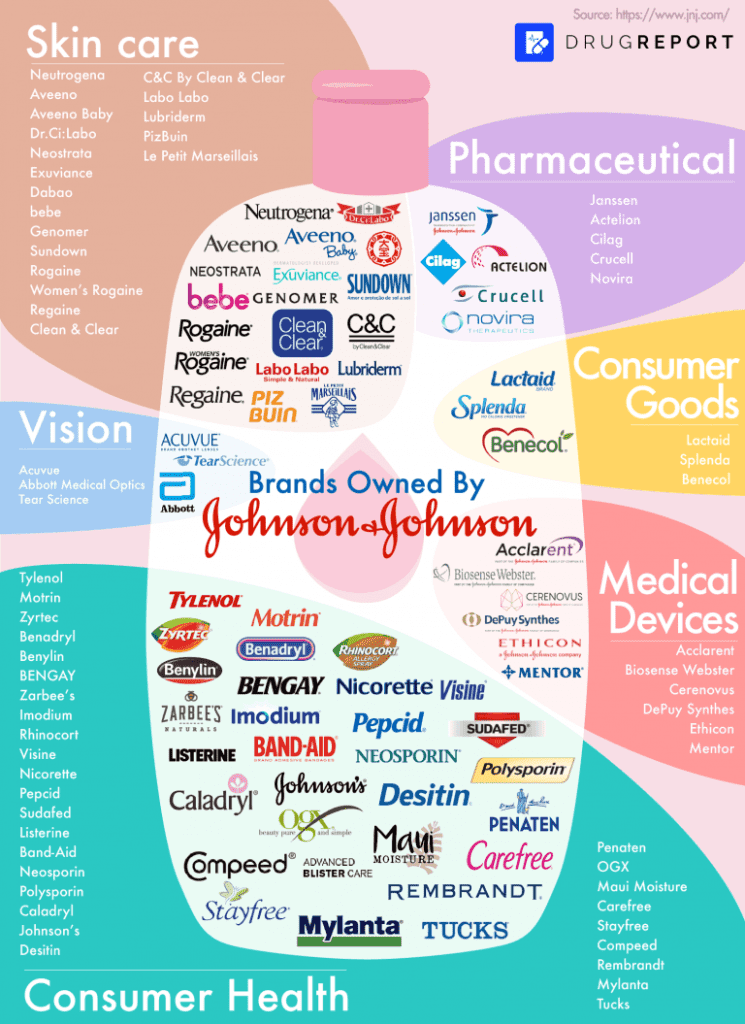

Johnson & Johnson has been around since 1886. That’s over a century of making healthcare products that we often recognize. From Band-Aids to baby shampoo, J&J has built a reputation for quality. This brand trust can translate into steady sales, which is something investors love to see. Due to their strong product presence, Johnson & Johnson can weather any storm that hits the global markets. When covid hit, their sales jumped because their products were in demand.

J&J has consistently shown strong revenue growth over the years. In recent reports, J&J’s earnings have hit new highs, boosting investor confidence. A company that generates solid profits usually means it can weather tough times, and J&J has a history of just that.

They are close to hitting the $100 billion market and with their product range and new products they are developing, I can see them hitting this mark in the next 5 years.

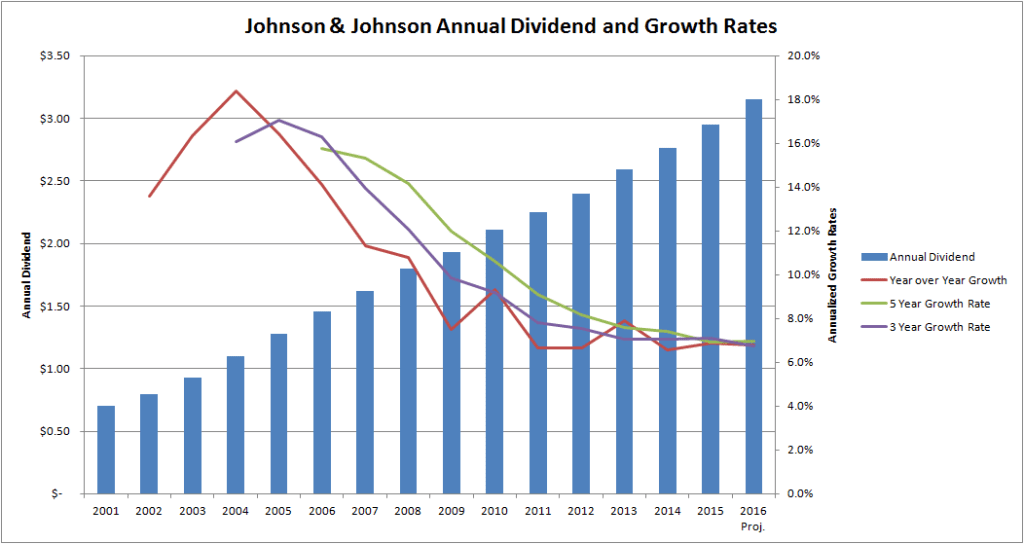

Dividends: A Sweet Incentive

Johnson & Johnson offers a very sweet dividend. They have been paying dividends since 1995, which makes this company a strong dividend player. Anyone looking for companies that pay out and grow their dividends over time, needs to look at J&J. Currently, the dividend yield is 3.11%, which pays out an annual dividend of $4.96. Their P/E ratio sits at 11.54 which is pretty good for a healthcare company.

Coca-Cola

Coca-Cola has been a staple in the beverage industry for decades. But the question is, is Coca-Cola A Good Investment? Coca-Cola operates in over 200 countries. This extensive global footprint provides stability and opportunities for growth across diverse markets. Since its inception in the late 19th century, Coca-Cola has grown to become one of the most recognized brands in the world. Its signature red and white logo is synonymous with refreshment and enjoyment for many consumers.

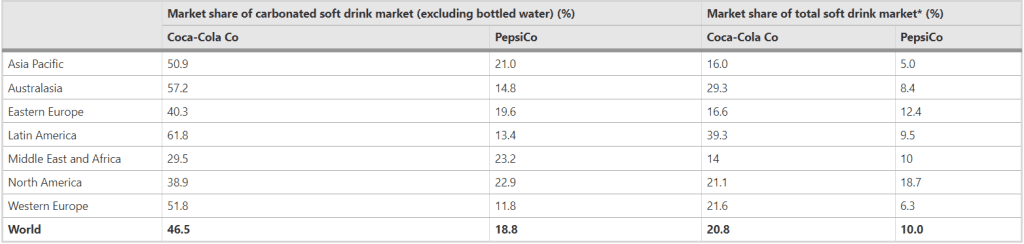

Market Share and Competition

Despite facing stiff competition from other beverage companies, Coca-Cola has maintained a significant market share globally. Its diverse product line and innovative marketing strategies have helped it stay ahead of the curve. The company’s biggest competitor is PepsiCo. The two clash when it comes to beverages, however, PepsiCo has the advantage overall due to their large product base.

Even with this competition, Coke is still the drink of choice for the vast majority of consumers. It dominates the American markets as well as the European markets. Coca Cola dominates in other markets as well.

Dividends

Coca Cola (KO) offers a dividend yield of 3.08% which pays out $0.4850 per quarter. This power house is also part of the Dividend kings club which means the company has a record of dividend growth spanning 50 years or more. This means the company has not missed a dividend payment and has regular increased its dividend yield.

This makes it such a quality dividend stock that can be held long-term. This happens to be one of Warren Buffetts favorite stocks. He currently owns more than 400 million shares. This equates to $775 million in dividend payments.

PepsiCo

PepsiCo, a global leader in the food and beverage industry, is known for its iconic brands like Pepsi, Lay’s, Gatorade, and Tropicana. With a rich history spanning decades, PepsiCo has established a strong presence in the market. They continue to develop, acquire and expand their presence.

PepsiCo owns more than 500 brands. This staggering amount gives them the ability to capitalize on the food market share. This means PepsiCo can gain traction when it comes to chips, snacks, soft drinks, bottled water, in-home products and more. PepsiCo’s product portfolio includes a wide range of enjoyable foods and beverages, including many iconic brands that generate more than $1 billion each in estimated annual retail sales.

Financial Performance

Analyzing PepsiCo’s financial performance is crucial in determining its viability as an investment. Over the years, PepsiCo has demonstrated consistent revenue growth and profitability, reflecting its strong business model and market position.

- PepsiCo revenue for the twelve months ending March 31, 2024 was $91.875B, a 4.36% increase year-over-year.

- PepsiCo annual revenue for 2023 was $91.471B, a 5.88% increase from 2022.

- PepsiCo annual revenue for 2022 was $86.392B, a 8.7% increase from 2021.

- PepsiCo annual revenue for 2021 was $79.474B, a 12.93% increase from 2020.

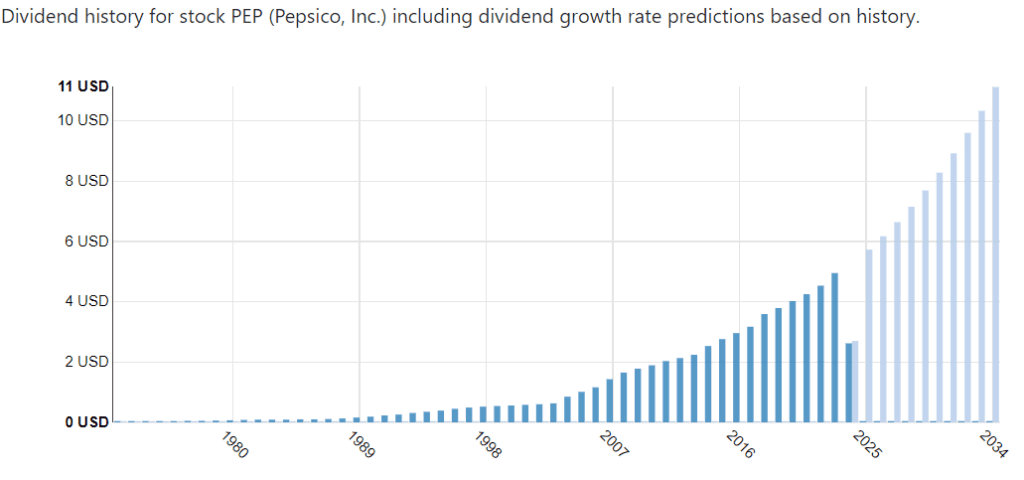

Dividend Trends

Understanding market trends is essential in predicting future stock performance. PepsiCo has adapted to changing consumer preferences by introducing healthier product options and expanding its presence in emerging markets. This strategic approach positions PepsiCo well for sustained growth.

Because of their continued growth and development, this has led to PepsiCo consistently raising their dividends throughout the years. And the graph below shows what it could be in the future if the trend continues. The company’s current dividend yield is 3.02%, which pays out $1.35 per share.

Hershey Brands

When it comes to investing, everyone wants to find that golden nugget. Well, Hershey, the iconic chocolate company, might just be that treat. With a worldwide presence and a large consumer base, this beloved company is a powerhouse in the comfort food world. Let’s unwrap why Hershey is a stock worth adding to your portfolio and if Hershey is a Good Buy.

A Brand That’s Loved Worldwide

Hershey is more than just a chocolate maker; it’s a beloved brand. From the classic milk chocolate bar to the famous Reese’s Peanut Butter Cups, to pretzels and popcorn; Hershey’s products have a special place in people’s hearts. This brand loyalty means customers keep coming back for more. And when customers are happy, that’s a good sign for investors. I currently own this stock and I am very pleased with it. It’s worldwide recognition and its ability to weather tough times is a solid pick for me.

Diversification in Product Offerings

Hershey isn’t just about chocolate bars anymore. The company has branched out into various categories, including snacks, baking products, and even healthier options. This diversification helps Hershey tap into different markets and appeal to a wider audience. Think of it as a buffet: the more options available, the more people will want to dig in. Currently, the company boasts an impressive 90 brands and products that they sell.

Some of the below products they sell are;

- Kit Kats

- Mr. Goodbar

- Twizzlers

- Jolly Rancher

- Skinny Pop

- Dots Pretzels

Strong Dividend History

For income-focused investors, Hershey has a sweet treat—a consistent dividend payout. The company has a solid history of paying and increasing dividends, making it an attractive choice for those looking for steady income. They have been paying a dividend since 1995! That is a solid time frame and if that was not enough to sell you, they have had 15 years of consecutive dividend increase. They currently sit at a 2.89% dividend yield with an annual payout of $5.48. For any investor, this is a solid choice.

Pfizer

When it comes to investing in pharmaceutical companies, picking the right one is crucial. These companies work on and develop drugs that could be the next cure of the century or the next flop. So the question remains, Is Pfizer a Good Stock to Buy? My answer? Yes! Let me explain why.

Financial Health: A Closer Look

Understanding the financial state of a company is like checking the oil in your car; you want to ensure everything’s running smoothly. Pfizer has shown strong revenue growth in recent years, largely due to its COVID-19 vaccine and treatments. This financial boost has increased investor interest.

However, keep an eye on upcoming patent expirations. When patents run out, it can mean less exclusive control over certain drugs, which may impact future revenue. So, while Pfizer’s current financials look robust, it’s essential to think long-term.

Let us take a look at their revenue over the last few years. As you can see, their revenue fluctuates a bit but overall is solid. The company is earning $50+ billion a year, this creates a solid base for the company.

- Pfizer revenue for the quarter ending March 31, 2024 was $14.879B, a 19.51% decline year-over-year.

- Pfizer revenue for the twelve months ending March 31, 2024 was $54.889B, a 41.08% decline year-over-year.

- Pfizer annual revenue for 2023 was $58.496B, a 41.7% decline from 2022.

- Pfizer annual revenue for 2022 was $100.33B, a 23.43% increase from 2021.

- Pfizer annual revenue for 2021 was $81.288B, a 95.16% increase from 2020.

Conclusion

You can not go wrong with any of these companies. They have a solid history, solid backing, solid product base and a solid customer base. They are strong contenders in the market and as I said before, a solid start to any portfolio. If you are not sure what to buy for your first time, these would be my suggestions. I currently have all of these in my portfolio and I plan to hold them long-term.

Related Posts

Disclaimer

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial.