Is MO a Good Stock to Buy? Unpacking Altria Group’s Investment Potential

Investing in stocks can be like navigating a sea of uncertainty, where every wave in the market could either make or break your portfolio. One company that frequently catches the eyes of investors is Altria Group, Inc. (MO). This company boasts a wife product range and solid profits. However, there is the moral part of the equation. Do you want to own a stock in a company that produces a product that kills people? I firmly believe people are adults, it is not my place to be the judge of that. If I want to own this stock, I should not feel guilty about it.

But, is MO stock a wise addition to your investment basket in September 2024? Let’s explore it together.

Our Sponsor

Understanding Altria Group: What Makes MO Tick?

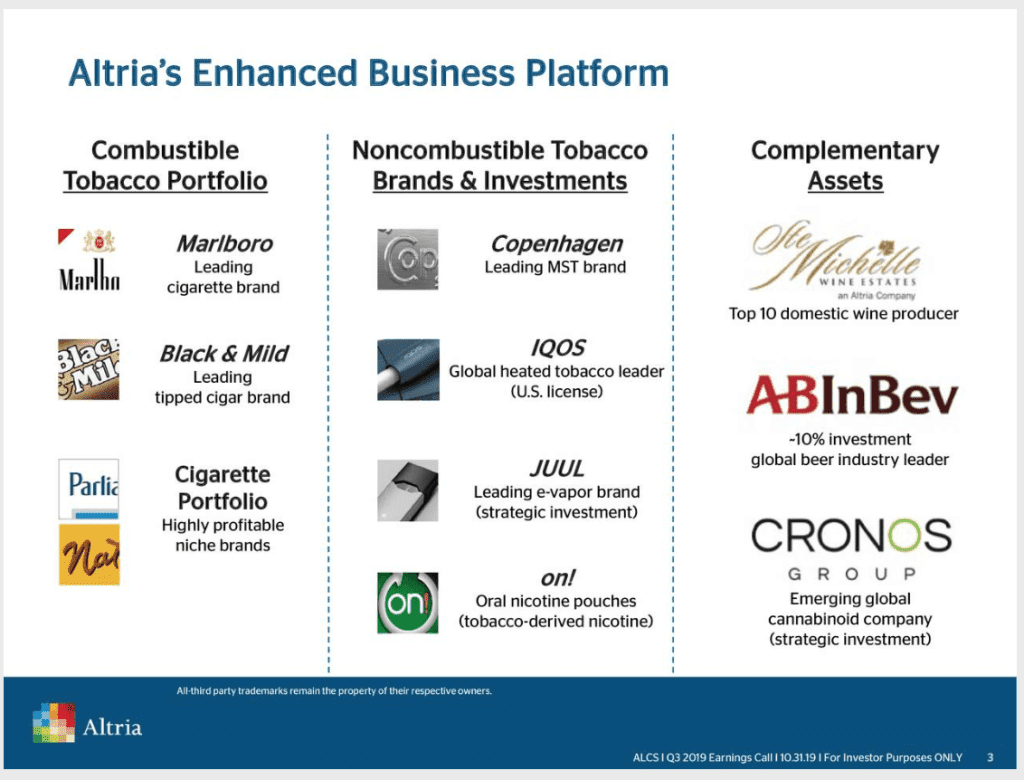

Altria Group is more than just a tobacco company; it’s a giant in the Fortune 200 list, primarily known for its flagship brand, Marlboro. But Altria has diversified over the years, branching into wine, cannabis, and other sectors. This diversification strategy plays a crucial role in whether or not MO is a good investment choice.

Altria’s Marlboro brand holds a commanding sway over the U.S. cigarette market. Despite the downward trend in cigarette consumption, the brand’s strong pricing power has helped retain robust revenue streams. Could Altria’s dominance in a declining industry be a hidden asset, or is it a risk waiting to unfold?

Diversification and Strategy

The move towards non-tobacco products has been pivotal for Altria. With a stake in Juul, a leading e-cigarette manufacturer, and investments in cannabis through Cronos Group, Altria’s strategy seems multifaceted. Will this expansion cushion its traditional tobacco revenue, or is it spreading its wings too thin? I do not think so. If anything, this is a good thing. The company is trying to stay ahead of the times and stay relevant. Tobacco will always be here, probably not at the height it once was, but people will continue to smoke. By adding more options to the company’s portfolio, this ensures the company will stand the test of time.

MO’s Financial Health: Numbers That Matter

When deciding on stock investments, it’s crucial to consider the financial standing of a company. Here’s where Altria stands. Currently, the company has seen a decline in its revenue. This is due to cigarettes becoming more of a taboo item. As the world becomes more health conscious, smoking has become less and less of a desirable trait to have. However, even with this decline, the company still reports solid numbers. As they continue to expand into other products, such as marijuana, I can see the company turning out record profits again.

- Altria revenue for the quarter ending June 30, 2024, was $6.209B, a 4.59% decline year-over-year.

- Altria revenue for the twelve months ending June 30, 2024, was $24.041B, a 3.4% decline year-over-year.

- Altria annual revenue for 2023 was $24.483B, a 2.44% decline from 2022.

- Altria annual revenue for 2022 was $25.096B, a 3.53% decline from 2021.

- Altria annual revenue for 2021 was $26.013B, a 0.54% decline from 2020.

As you can see here, even with a decline in revenue, their profit margins rose. This is a good sign for the company.

- Altria gross profit for the quarter ending June 30, 2024, was $3.675B, a 2.18% decline year-over-year.

- Altria gross profit for the twelve months ending June 30, 2024, was $14.153B, a 0.98% decline year-over-year.

- Altria annual gross profit for 2023 was $14.284B, a 0.27% increase from 2022.

- Altria annual gross profit for 2022 was $14.246B, a 1.82% increase from 2021.

- Altria annual gross profit for 2021 was $13.992B, a 7.44% increase from 2020.

The Dividend Dilemma

Dividends are a big draw for many investors, and Altria is no stranger to this. The company has consistently paid dividends for years, making it attractive for those looking for a steady income. However, there’s chatter about whether they can sustain their high dividend payout if their core business continues to shrink. Will continued payments hold, or is the company playing with fire? I believe MO can safely continue with their high payments due to them branching into other products. As you saw above, with their profits, they are becoming more and more profitable.

Currently, MO has a dividend yield of 7.46% which pays out $3.92 annually per share.

Is MO a Good Stock to Buy?

While its dividend yield is attractive and its diversification offers potential, regulatory challenges and shifting market trends pose real threats. If dividends and traditional markets align with your investment strategy, MO might be a bright beacon. However, if you’re wary of potential regulatory shifts, tread carefully. As always, remember to align stock picks with your financial goals and risk tolerance. Altria symbolizes the tantalizing tug-of-war between risk and reward that every investor faces. The decision is yours. For myself, I plan to continue adding more shares of this company. I foresee it being a good buy for the time being.

Disclaimer

I am not a financial advisor or licensed stockbroker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial.