What is Cryptocurrency and How Does It Work?

From Ethereum and Bitcoin to Dogecoin and Tether, cryptocurrency, often dubbed as crypto has been a buzzword in the finance niche for over three decades now. However, it has only been a few years since cryptocurrencies really exploded in popularity, drawing attention globally. If you are just hearing about this word, here is a simple guide that will shed light on what it is, and how you can get started on the crypto world.

What is Cryptocurrency and how does it work?

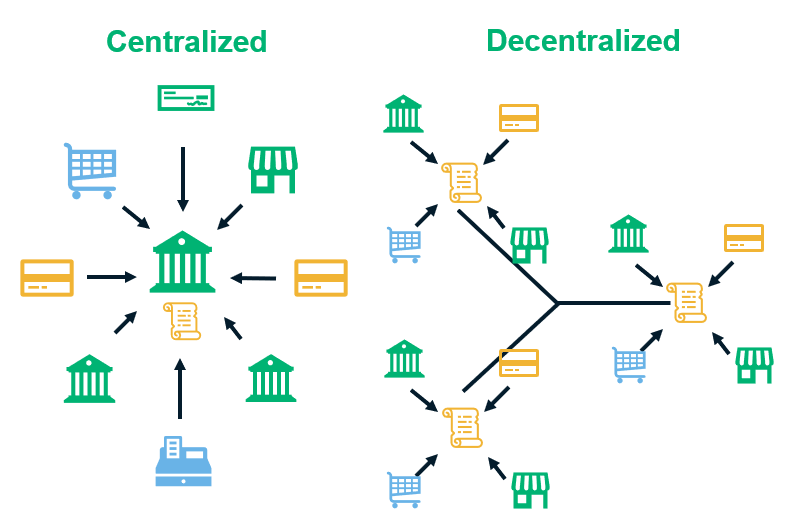

Cryptocurrency is a decentralized and encrypted medium of exchange. Simply put, a digital currency does not require a financial institution such as a bank or a credit card company to verify transactions. Instead, transactions are recorded and verified in a blockchain, a digital ledger that houses data that is available for anyone to access and verify. Most cryptocurrencies are fashioned to serve as a medium of exchange but they can also be used to represent asset ownership.

How are Cryptocurrencies Created?

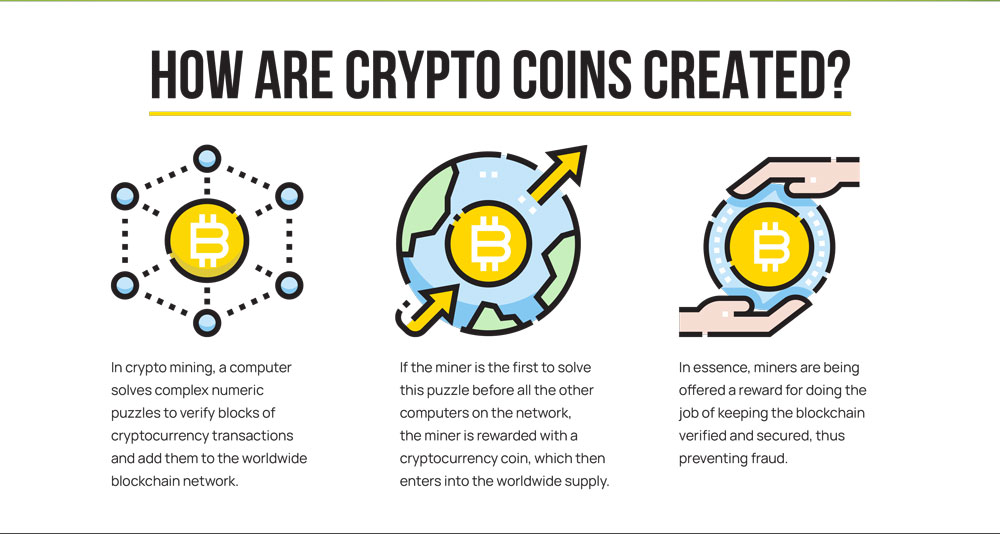

Cryptocurrencies are created through a process called mining. As stated earlier, the transactions made with crypto need to be validated. Mining validates transactions and in the process, new units of crypto are created. Every time a cryptocurrency transaction happens, thousands of crypto miners compete to decrypt the block containing the transaction information.

Decrypting a block provides information on who sent how many cryptos, to whom, and at what time. However, that is not all; the decrypting process also authenticates the transaction. The first miner to decrypt a block is rewarded with a fraction of a crypto unit. This verification process also known as mining can be resource intensive as it requires a lot of computational power.

Since crypto mining can be expensive for an individual, miners join pools of other crypto miners in order to use computing power collectively.

Advantages of Cryptocurrency

- Faster Local and Global Transactions

Unlike the traditional methods where it can take up to three business days to complete a transaction, cryptocurrency transactions can be completed in a matter of minutes.

- Protection From Inflation

Although cryptocurrencies are not exactly, inflation-proof they can be termed as inflation-resistant and way safer compared to the traditional currency. Since crypto such as Bitcoin is scarce, its value remains protected because the demand remains steady even in times of rising inflation.

- Cost Effective

Since the use of cryptocurrency eliminates the need for an intermediary such as a bank or credit card company to verify transactions, the cost of transfer is negligible.

- Easily Accessible

With just a smartphone, internet connection, and a computer, investors can get into crypto trading or investing with no hassle. To open a crypto wallet, you will not need any background check, credit score, or even identity verification.

Disadvantage of Cryptocurrency

- Price Volatility

The value of crypto especially, the top performers such as Bitcoin can be very volatile.

- Scam

Because cryptocurrencies are not regulated, it has been a hub for fraud for years. Its anonymous nature also means it can be used as a payment method by fraudsters.

- Unregulated Market

In addition, because the market is unregulated, there are no rules or laws in place to protect businesses and investors.

How to Invest in Cryptocurrency

If you want to invest in crypto, here are a few steps you can take to get started:

- Study different cryptocurrencies and choose which ones to invest in

- Settle for a good crypto trading app. Robinhood is a great option, especially for newbie investors.

- Choose a cryptocurrency exchange. Binance is a great example of a cryptocurrency exchange that is suitable for beginners.

- Select a digital wallet to hold your crypto

- Decide the amount you want to invest