What Happens To Your Investments After You Pass Away?

No one likes to think about death but unfortunately, that is a part of life. Eventually, death will come knocking and He will take you away. What does this mean for you and your family? For the purpose of this article, what does it mean for your investments? What will happen to the portfolio you worked hard to build? I hope I can answer this for you in this article. This was surreal for me. Writing this knowing one day, I will eventually meet my fate and the investments I buy now and in the future will be left in the hands of someone else.

Investing can help you diversify your portfolio and build wealth. However, what happens to that wealth after you are gone? Your investments become part of your estate. Your will will determine who is entitled to what and how your investments will be split. It is important to create a will and designate a beneficiary. I would suggest hiring a financial advisor that can help you plan your estate and put together a plan for your family after you are gone.

What Happens to Stocks When You Die?

This will depend on the provisions made before your death. There are a few ways you can prepare for this:

- Add one or more beneficiaries to your investment account. I use Fidelity and they ask for this pretty often if you do not set one.

- Name a beneficiary in your Will.

- Name a transfer of death (TOD) beneficiary.

I do not have a will yet so I am replying on option #1 now. By designating a beneficiary, they will gain your account in its entirety. All your investments will transfer to this person. This is probably the easiest way to transfer your investments, especially if you are married. My wife is listed for mine so this gives me peace of mind knowing my portfolio will be hers if something bad happens to me.

Transfer on Death Beneficiary

Here is a list of states that have a special beneficiary designation know at Transfer on Death (TOD). By naming someone as a TOD, they will gain ownership of your assets upon your death. In addition, while you are alive and well, they will not be able to access your assets. However, once you pass away, they automatically assume ownership of those assets.

As of 2022, 30 states and the District of Columbia recognize transfer on death designations:

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- District of Columbia

- Hawaii

- Illinois

- Indiana

- Kansas

- Maine

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Ohio

- Oklahoma

- Oregon

- South Dakota

- Texas

- Utah

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

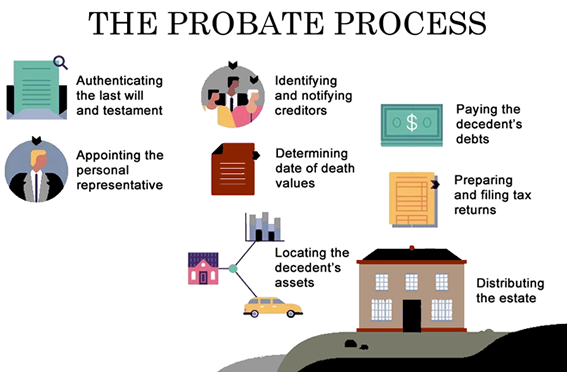

The benefit of this, if allowed by your state, would be that you avoid probate. Probate is the legal process by which a person’s assets upon death are inventoried, any debts you might have are repaid by your estate and the remaining assets are distributed to your beneficiaries. This process of this is time-consuming and very costly. If you have a large estate or any disputes over who will become the heir, it can drag on and cause unnecessary loss of money. A transfer on death designation allows your named beneficiary to bypass this process for stocks and other securities in your investment accounts.

Distributing Stocks in a Will

A last will and testament is a legal document that specifies how you would like your assets to be distributed. This would include your 401k or IRA accounts, investment accounts, buildings, cars, businesses, etc. You can leave instructions on how you want your estate to be divided, such as who gets what and how much of it.

The benefit of using a will for your investment portfolio is you can decide how you want to divvy it up. For example, if you own 1,000 shares of Tesla and you want your four kids to have an equal piece of the pie, you can designate each person to receive 250 shares.

If you create a will, any assets included in that will be subject to probate. To avoid probate, you can create a trust. A trust is a legal arrangement in which transfer your assets and its ownership to the trust. You can act as your own trustee during your lifetime and designate who will succeed you. I plan to do this for myself because I want my portfolio to grow after I am gone and eventually act as a source of income for my family.

However, there is a downside to a trust. Maintaining one can be costly and depending on the state, there could be rules regarding them. I would suggest talking a financial planner to discuss and set up your trust.

What Happens to Stocks When You Die Without a Will?

You should make sure you create a will for your family. When you pass away without a will, you are subject to your states inheritance laws. Some states will bypass your wife and give your estate to your parents if they are still alive. Creating a will is essential for keeping your family taken care of.

Normally, the order, in which inheritance works is your spouse first, then your children and then other relatives. As mentioned above, this can change depending on your state and parents can supersede the spouse. The best way to avoid this situation would be to have a will, a trust or designate a beneficiary.

Now, what happens to your stocks if you die with no heirs? In this situation, if the state is unable to find anyone to assume ownership of your investments, any assets left behind will become property of the state. If you do not have anyone to leave your estate behind, you can always designate a charity. This way your estate can do some good after you are gone. To me, letting the state take control would be horrible. The state does not deserve your hard work.

What to Do If You Inherit Stocks

You will need to contact the brokerage firm that your spouse, family member or friend was using and notify them of the person’s death. You will need a death certificate and will be required to provide documentation proving you are now the owner of the stocks. You will have to set up your own brokerage account to have the assets transferred to you. From here, please designate a beneficiary.

Estate Planning

Consult a financial advisor and plan your estate. Finding one is not hard and when looking for one, read their reviews. Find an advisor that cares about you and your financial future. Life is uncertain, so planning now is paramount. Your family will be grateful you did this now. Having family fight over assets is a horrible way to remember someone.