13 States That Won’t Tax Your Retirement Income

Each state has various tax laws that when you examine them is simply horrendous. These laws were created to benefit people with money, for the middle class, and below to suffer. The average millionaire and billionaire in the vast majority of the time will have a lower tax percentage then you will. Navigating this can be daunting. When it comes to investments, such as buying and selling to profit or dividend investing, you need to know your tax laws. You should also know the laws regarding your 401k and other retirement accounts.

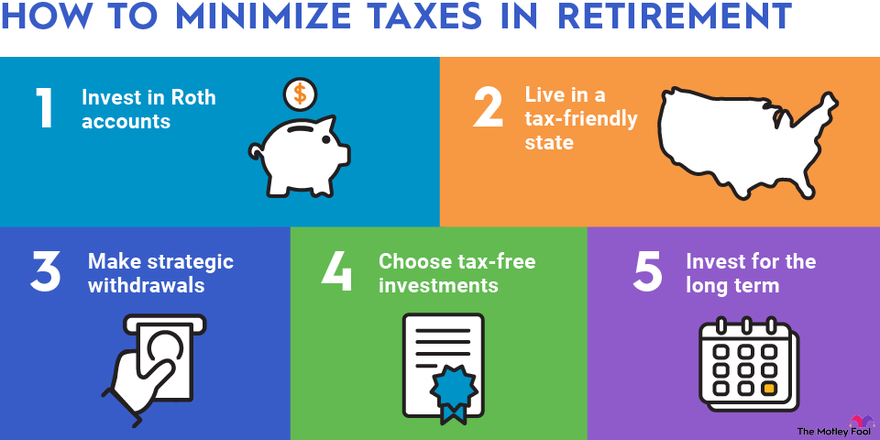

Relocating to a state that is tax friendly and will not tax your retirement income could be beneficial and could end up saving you money. However, research each state and their laws before committing. Some states only tax certain types of income, while others do not tax income at all. Another reason I say to research before moving so you can maximize your benefits.

If your retirement income includes Social Security benefits, distributions from a 401(k) or IRA, or a pension, you will not see a tax bill from the states on this list.

Disclaimer – Do Your Research! I cannot stress this enough, before any major financial decisions, please consult a professional.

Tax on retirement income

The states on this list do not tax “traditional retirement income”, however, you still might have to pay taxes on other types of income you earn while in retirement, such as wages, interest, dividends, etc. In addition, federal income tax applies to the states on this list.

States listed in Alphabetical order

Alaska

Alaska has no state inheritance or estate tax. The state will not tax your social security benefits or your pension. If you have a 401k or IRA, these are also tax-free. The reason being is because Alaska has no state-income tax. Another benefit to living in Alaska is that they will pay you to live there through their program titled, “Alaska’s Permanent Fund Dividend”. This fun was worth $3,284 as of 2022.

Florida

Florida has no state income tax and no estate or inheritance tax. In addition, a new bill designed for tax relief has made several items exempt from sales tax.

Illinois

Illinois does not tax you on your retirement income. In addition, pensions, IRA, 401k and social security benefits are tax-exempt.

Illinois does however, has a flat income tax rate of 4.95%. Earnings from other sources such as investments are taxable.

However, Illinois has a flat income tax rate of 4.95%, so earnings from other sources (such as investment income) are taxable. Estates valued at more than $4 million dollars are subject to an estate tax.

Iowa

This state does not tax retirement income. Starting this year, 2023, most retirement income is tax-exempt if you are age 55 or older. Social security is not taxed in Iowa but other types of income such as wages and investment income is taxed. These are usually taxed between 4.4% to 6.6% in 2023.

According to retirement income tax guidance released by the Iowa Department of Revenue, the following types are retirement income qualify for the exemption.

- Roth conversion income

- Distributions from qualified 401(k), 403(b), and 457(b) plans

- SEP plans

- SIMPLE retirement plans

Mississippi

Mississippi has a flat income tax rate of 5%, but this does not apply to 401k, IRA, pensions or social security benefits. However, by 2026, the 5% is set to decrease gradually until it reaches 4% This state does not have an inheritance tax or estate tax.

Nevada

Nevada joins the list of states that have no state income tax. A bonus to Nevada is that you do not pay state taxes on investments. No estate tax or inheritance tax either.

New Hampshire

Retirement income is exempt in New Hampshire. The state does not have a state income tax either. Social security benefits, pensions, IRA, and 401k will not be taxed.

However, New Hampshire will tax interest and dividends. Listed in order of year.

- New Hampshire’s I&D tax is 4% for 2023.

- The tax reduces to 3% in 2024.

- The I&D tax drops to 2% in 2025.

- In 2026, the I&D tax falls to 1%.

- New Hampshire plans to not tax interest and dividends by 2027.

Pennsylvania

This state will not tax your IRA, 401k, social security or pensions. However, other types of income are taxed at a flat rate of 3.07%. Wages or investment income are subject to this tax. If you plan to earn money from your investments, you might not save as much. In addition, they tax inheritance.

- Children 21 and younger are exempt from Pennsylvania’s inheritance tax.

- Children over the age of 21 pay an inheritance tax of 4.5% in Pennsylvania.

- Tax rates in Pennsylvania range from 4.5% to 12% for other heirs.

South Dakota

South Dakota does not have a personal income tax. This means your retirement income will be exempt. Dividend and interest is not subject to state tax either. Another benefit is that there is no inheritance or estate tax.

Tennessee

Like South Dakota, Tennessee does not tax personal income. Only thing to worry about will be your federal taxes on social security benefits, IRA plan, 401k and your pension. No inheritance or estate tax either.

Texas

Texas has no personal income tax. Retirement income will not be taxed and if you decide to keep working, your wages will not be taxed either. In addition, there is no inheritance or estate tax.

Washington

Washington has no state income tax, this means your pension, 401k, IRA or social security is safe from being taxed. However, the Washington Supreme Court recently upheld the state’s capital gains tax. What this means is, there is a 7% tax on some capital assets (stocks and bonds). The good news is that this only applies to any financial gains that exceed $250,000 annually.

Wyoming

This lovely state does not state your income, interest or dividends. The state has no personal income taxes and no corporate income tax. In addition, there is no inheritance or estate taxes.