Warren Buffett’s Portfolio: What He Is Buying and Selling

If you are new to dividend investing or you have been doing it for years, this name will not be new to you. Hell, even if you do not invest this name should not be new to you. We are talking about the famous Warren Buffett. This man a genius when it comes to stocks, especially dividend stocks. If you want to learn how to invest like a pro, studying this man is the way to go.

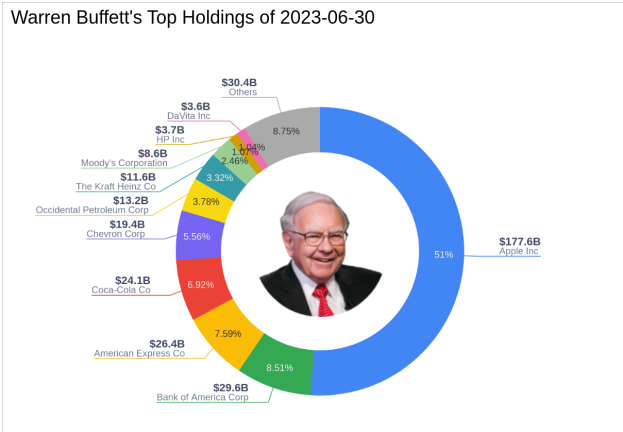

Warren Buffett’s trade are closely watched and a lot of the time even mimicked. His trades tend to do very well and investors try to gain the same success by watching what he does. The company that he owns is called Berkshire Hathaway and is worth an estimated 781.26 billion. That is an astonishing number.

Let us dive in to the investments Buffett and his two investment officers made. The two officers that work for Buffett are Todd Combs and Ted Weschler. This will be first quarter filings with the securities and exchange commission, dated June 30, 2023.

Berkshire Hathaway’s portfolio: Buying/Adding

First stock on the list is Capital One Financial. Buffett took advantage of bank stocks suffering in the first quarter. They currently own 12.5 million shares, worth an estimated $1.36 billion dollars. This is up from their original amount of 9.9 million shares.

Our second stock is D.R. Horton. Berkshire started a new position in this company, adding six million shares to their portfolio. The state is worth $736 million dollars. Surprising move considering interest rates and mortgage rates have skyrocketed. This is a homebuilder stock.

Our third stock is Lennar. Lennar is also a new position that Berkshire Hathaway added to their portfolio. The company added 152,572 shares, worth $18.9 million dollars. This is a homebuilder stock.

Our fourth stock is NRV. Like our previous two, this is a homebuilder stock. Berkshire added this company to their portfolio with 11,000 shares worth $68.4 million dollars.

Our fifth stock on the list is Occidental Petroleum. The company added 4.66 million shares on Thursday, bringing its total ownership to 222 million shares worth $13 billion.

Our sixth stock is OXY. Berskhire Hathaway added 12 millions, making its total share count at 224 million. This position is worth $14.6 billion dollars. In five of the last six quarters, Berkshire added this stock to their portfolio.

Berkshire Hathaway’s portfolio: Selling

Number one on our list is General Motors. Berkshire cut 20 percent in the first quarter. The company now owns 22 million shares. These shares are worth $750 million dollars.

Number two on the list is Globe Life. Berkshire cut more than 60 percent of their stake in the company. They went from 6.35 million shares to 2.51 million. This new position is worth $289 million.

Number three is Marsh & McLennan. Berkshire closed their stake with the company, cutting 405,000 shares.

Number four on the list is Vitesse Energy. After grabbing a small amount of shares in the first quarter, the company cut their stake in the company by the second quarter. Berkshire’s position was worth only $1 million at the time.

Number five on the list is Chevron. Berkshire trimmed their stake in the company by 7 percent, bringing their total to 123.1 million shares left in the company.

Number six on our list is Celanese Corp. Berkshire cut their shares by 39 percent, bringing their total amount left to 5.36 million shares. These are worth an estimate $666 million dollars.

Number seven on our list is Activision Blizzard. Berkshire reduced their stake in the video game maker, which agreed to be bought out by Microsoft. Berkshire had 49.9 million shares before the selloff and now has 14.7 million shares in the company.

Number eight on the list is McKesson Corp. Berkshire closed out their position in the company. Shares at the time were worth $815 million dollars.

Conclusion

Berkshire Hathaway has an amazing record of accomplishment when it comes to investing but always do your research. Do not be a follower when it comes to investing. This can lead to a bad outcome as some people have the money to lose if they need to while others cannot afford to take big gambles. Please do your research.