Coca-Cola A Good Investment?

Coca-Cola has been a staple in the beverage industry for decades. But the question is, is Coca-Cola A Good Investment? Coca-Cola operates in over 200 countries. This extensive global footprint provides stability and opportunities for growth across diverse markets. Since its inception in the late 19th century, Coca-Cola has grown to become one of the most recognized brands in the world. Its signature red and white logo is synonymous with refreshment and enjoyment for many consumers.

Financial Performance

When evaluating Coca-Cola as an investment opportunity, one must consider its financial performance. Over the years, Coca-Cola has consistently delivered strong revenue and profits, showcasing its stability in the market.

Our Sponsor

Gross Revenue:

- Coca-Cola Consolidated revenue for the quarter ending March 31, 2024 was $1.592B, a 1.27% increase year-over-year.

- Coca-Cola Consolidated revenue for the twelve months ending March 31, 2024 was $6.674B, a 4.8% increase year-over-year.

- Coca-Cola Consolidated annual revenue for 2023 was $6.654B, a 7.3% increase from 2022.

- Coca-Cola Consolidated annual revenue for 2022 was $6.201B, a 11.47% increase from 2021.

- Coca-Cola Consolidated annual revenue for 2021 was $5.563B, a 11.09% increase from 2020.

Gross Profit:

- Coca-Cola Consolidated gross profit for the quarter ending March 31, 2024 was $0.641B, a 2.64% increase year-over-year.

- Coca-Cola Consolidated gross profit for the twelve months ending March 31, 2024 was $2.615B, a 9.22% increase year-over-year.

- Coca-Cola Consolidated annual gross profit for 2023 was $2.599B, a 14.08% increase from 2022.

- Coca-Cola Consolidated annual gross profit for 2022 was $2.278B, a 16.57% increase from 2021.

- Coca-Cola Consolidated annual gross profit for 2021 was $1.954B, a 10.47% increase from 2020.

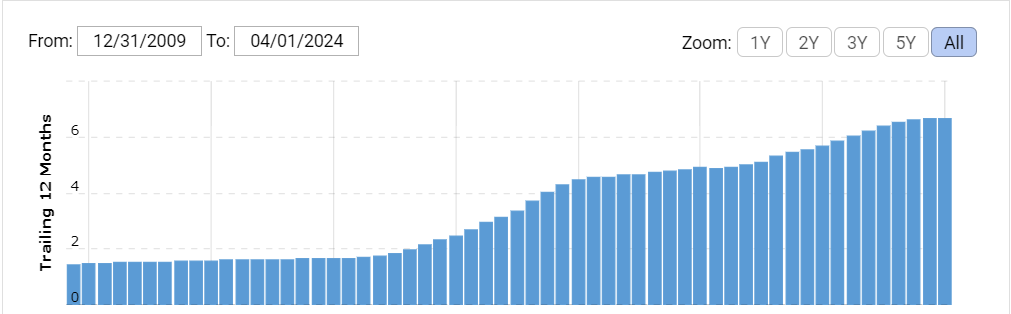

In 2009, Coca Cola was at 1.443 billion in revenue. If we fast forward to 04/01/2024, Coca Cola hit 6.674 billion in revenue. That is a tremendous jump.

Market Share and Competition

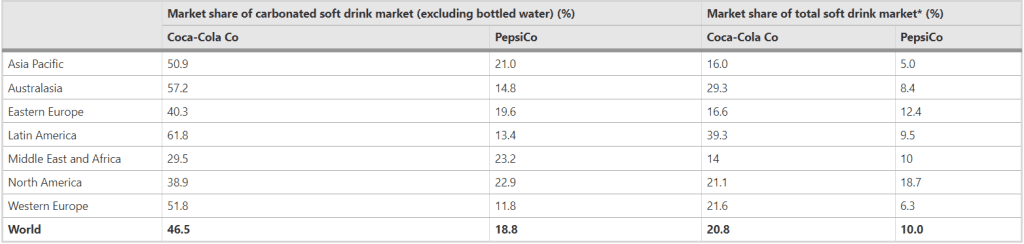

Despite facing stiff competition from other beverage companies, Coca-Cola has maintained a significant market share globally. Its diverse product line and innovative marketing strategies have helped it stay ahead of the curve. The company’s biggest competitor is PepsiCo. The two clash when it comes to beverages, however, PepsiCo has the advantage overall due to their large product base.

Even with this competition, Coke is still the drink of choice for the vast majority of consumers. It dominates the American markets as well as the European markets. Coca Cola dominates in other markets as well.

Dividends

Coca Cola (KO) offers a dividend yield of 3.08% which pays out $0.4850 per quarter. This power house is also part of the Dividend kings club which means the company has a record of dividend growth spanning 50 years or more. This means the company has not missed a dividend payment and has regular increased its dividend yield.

This makes it such a quality dividend stock that can be held long-term. This happens to be one of Warren Buffetts favorite stocks. He currently owns more than 400 million shares. This equates to $775 million in dividend payments.

Is Coca-Cola A Good Investment?

Yes, I believe it to be. I currently own the stock myself and plan to hold long-term and will continue to add to my position. However, I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. Factors such as changing consumer preferences towards healthier options, regulatory changes, and competition are challenges that Coca-Cola, like any other company, must navigate. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial.