Earn $800 a Month Off Dividends!

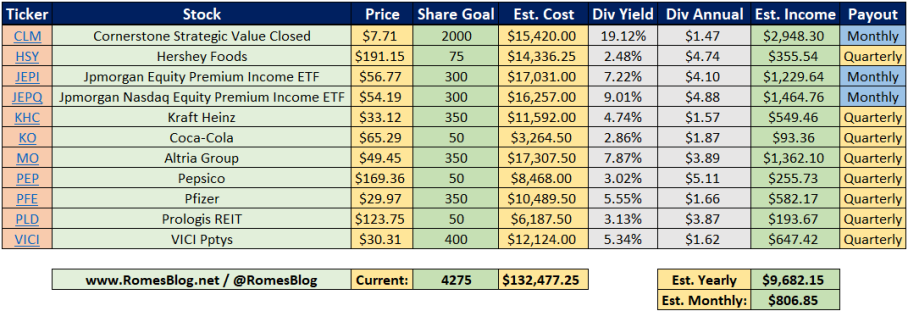

Retirement should feel like a well-deserved vacation, not a money scramble. One way to make your golden years shine is through dividends. But what exactly are dividends, and how can they help you during retirement? Let’s dive into the treasure trove of benefits that dividend payments can provide and how you can earn $800 a month off dividends. Check the bottom of the article for a list of stocks that will generate $800 a month and what it will cost to get that.

Our Sponsor

Check out our friends at Thousandaire on how to Double $10k Quickly!

What Are Dividends?

Dividends are cash payments made by companies to their shareholders. Think of them as rewards for holding onto a piece of the company. When you own stocks that pay dividends, you can receive these payments regularly—often quarterly. It’s like getting a paycheck while you enjoy your retirement. The more shares you own, the more dividends you receive. This is my favorite part of owning quality dividend stocks.

A Steady Income Stream

One of the biggest perks of dividends is the monthly or quarterly income they generate. Imagine having money rolling in just for owning a share of a company. This steady stream can cover everyday expenses like groceries, utilities, or even that long-desired trip to Bali. No more counting pennies; dividends can provide financial peace of mind.

Imagine having a guaranteed source of income that never dwindles. Your 401(K) account will shrink as the years go by, that is how you get your retirement checks each month. Your 401(K) will sell the shares each month and send you a check. This means your balance is constantly shrinking and eventually will run out. If you are lucky, it will last long enough for you to live a comfortable life during retirement. However, for most people this is not the case. Having $800 coming in each month is a life saver. Your Roth IRA account will never dwindle in shares because the companies you own are paying YOU to OWN them. Crazy right?

Compounding Returns

Dividends also have a magical ability called compounding. When you reinvest your dividends, you buy more shares of stock. This increases your potential future dividends, creating a snowball effect. It’s like planting a tree in your garden: the more you nurture it, the bigger the harvest you’ll reap in years to come. Over the long term, this can lead to significant growth in your investment portfolio.

Tax Advantages

Another hidden gem is the tax treatment of dividends. In many cases, qualified dividends are taxed at a lower rate than regular income. This means you can keep more of your hard-earned money. It’s like finding a friendly tax break during your retirement journey. If you invest using a Roth IRA, you can enjoy tax-free dividend payments each month because the Roth IRA account uses after-tax dollars to invest. This means your earnings in this account are tax free. However, be sure to check with a tax professional to fully understand how dividends fit into your financial picture.

Picking the Right Companies

There are a variety of quality dividend stocks to choose from. You can pick from the Dividend Kings or Aristocrats list to make life simple. I picked a few stocks that I personally own to help you see how you could earn $800 a month in dividends.

To reach the $800 using the example below, you will need to max out your Roth IRA account each year for 19 years. Seems like a long time right? It is not. People work 20-40 years, you might as well invest while you do. Investing while contributing to a 401(K) account is crucial for a healthy and comfortable retirement.

DISCLAIMER

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial. Consult a financial advisor if you are unsure how to proceed further.