How Do I Go About Buying Stocks?

You’ve probably seen the news and saw the stock ticker at the bottom or watched a video on someone talking about stocks and you decided that you want to own a few yourself. I am here to tell you that the whole process is easy to do. However, I strongly suggest contacting a licensed broker if you are unfamiliar with stocks. I also suggest that you do your own researching before buying any stocks. With that out of the way, there is an age requirement to purchase shares in a company. You must be at least 18 years old to open one, though, you can start earlier than this, but you’ll need a parent or guardian to open a custodial account for you.

What is a Custodial account?

A custodial account is a type of investment account that is managed by your parent or guardian. This account is opened for a minor before the age of 18, (21 depending on the state). After you turn 18, the account transfers to your own control and your parent or guardian loses the right to manage it. The benefits of this account, (If you are the minor in question), is that once assets are transferred to the account the parent or guardian cannot remove it. Any stocks, cash, or any other assets in this account belong to YOU the owner. Also, your parent or guardian cannot raid the account and anything removed from it must benefit you or go to you.

Now, for this account there is still taxes that need to be paid. Starting in 2022, the first $1,150 of unearned income such as dividends, interest or earnings from account, is tax-free. After that amount it is taxed at the child’s rate and if the account rises above $2,300, it will be taxed at the parent or guardian’s tax rate.

Buying Stocks

The process of buying stocks is fairly simple. You go to a brokerage firm and open an account. I use Robinhood and Fidelity to trade. I use Robinhood for crypto and Fidelity for my dividend stocks. After you have opened the account you will deposit money in said account and from there you will select the stock you want, confirm some stuff and done.

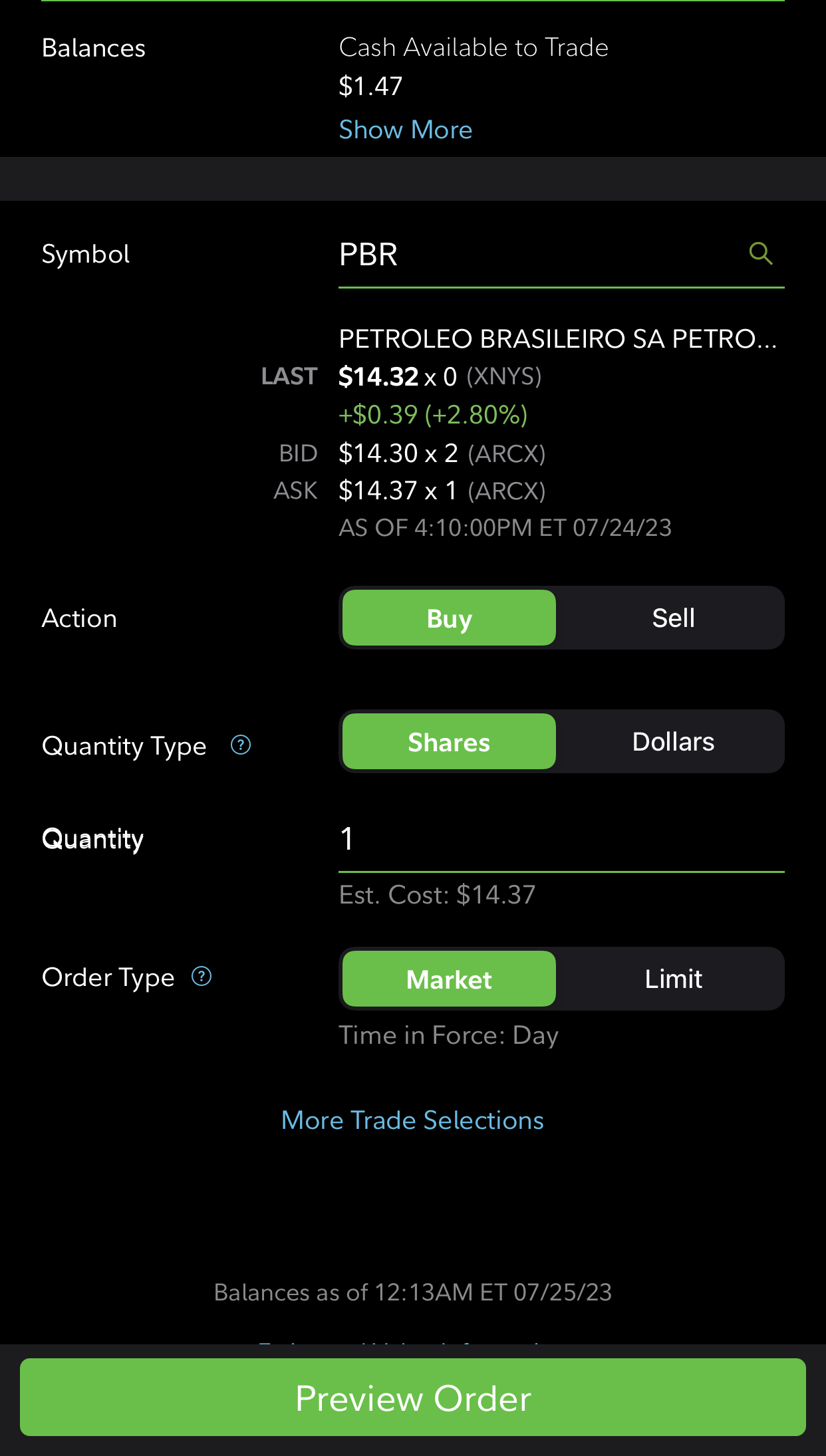

Look at the screenshot below, this was taken off the fidelity app. You’ll see at the top is your balance which is cash available to use to trade. As you can see, I have $1.47 left to trade with. Below that you will see the symbol field, this is the stock ticker abbreviation. Once you select a stock and click buy it will automatically pop up in this field. It will also list its last price and what you will buy it for.

From here you will see a Buy or Sell option (Depending on what you want to do with it), and under that you can select Shares or Dollars. This option merely means you can buy a set amount of shares or you can buy a specific dollar amount. The dollar amount sometimes will not work if the company you are buying from does not allow fractional shares. Some companies require that whole shares be bought.

You will type in how many shares you want and what order type you want. Market means you are buying for what it is currently selling at. You can use this option from 7AM to 3PM. After this, the stock is not guaranteed to be at that price if you select this option and will trade the next day. It would be higher or lower than the current day’s price. Limit orders means you set the price you want to buy it at and if it hits that price during the current day or next trading day it will buy or sell that stock for you with your selected price. You will then preview your order and select confirm.

See how easy that is? Buying stocks is very simple and anyone can do it. The hard part is doing the research and verifying stocks before you buy them. Some stocks may look good on the outside but can be rotten on the inside. You want to make sure you are not buying a stock from a company that could close up shop next year. You want to buy stocks from companies that have been around a long time, have stability financials and provide you with a good return. I only buy dividend stocks because those companies pay you to own the stock. For example, Coca-Cola (KO) pays you to own a piece of their company. We all love coke, the company has a strong presence so this one makes sense. But, as with everything, please do your due diligence and consult a licensed broker if you are not sure.

Thank you for reading! Please like and share and follow us on our socials.