How To Start Investing In College

You did it! You made it to college so now what? Well, the obvious answer is to do well in school, earn your degree and live a good life. However, that is what most people will tell you. I will tell you the same thing but I will add investing to the list. Most college kids have a job while in college so they can pay for living expenses, laundry, etc. Putting away $100-$200 a month will benefit you in the long run and set you up for financial freedom when you retire.

The sad truth is that more than 52% of Americans will not be ready for retirement. This means they will work until they are in their 80s or have to live a very modest lifestyle to retire at 62-67 range. An even sadder truth is that some people are still working in their 90s because they cannot afford to stop working.

I do not want this for any of you so please pay attention and read this article. If you are a parent or guardian, you need to read this as well so you can help advise your children. No one should have to work himself or herself until the end, make sure your kids are set up for the future. Teaching them now will save them later.

Disclaimer – I am not a licensed broker or financial planner. I am just a guy who loves to invest and does his own research. Please do your own research before buying any stocks.

Investing

Investing is a great way to set yourself up. Investing does not require large sums of money but it does require that you be responsible and disciplined. Investing does not require a lot of time or effort either on your part. All it takes is some research and a well thought out strategy. Moreover, no, I do not mean strategy as in a board game or anything like that but on how you want to invest. Some people prefer to play it safe while others like to jump in shark-infested waters. I myself prefer a strategy somewhere in the middle. I buy stocks that have a bit of risk to them not too much I could lose everything.

I suggest dividend investing. Dividend investing is the best strategy out there. Unlike stock traders who need to sit in front of a screen all day buying and selling, I buy stocks I know are good and that will pay me to own them. These stocks pay me monthly, quarterly and yearly. My goal is to own enough to where I make $3,000 to $4,000 per month off them by the time I retire.

When investing, patience is key. You need to be patient and not rush to rash decisions. Stocks will rise and fall daily. Sometimes they are hit hard and for me, when this happens I buy more. Cheaper the stock is, the better it is for me later when the price rebounds. If you get scared easily then this might not be for you. You might lose $200 in a day and panic sell while I see that and brush it off. I will regain that $200 eventually, I am not worried. Even if I lose that money, the company is still going to pay me each month or each quarter. I still make my money. Sadly, too many college students are impatient.

Also, some people might not like the slow gains. Investing $2000 and by the end of the year only seeing $2,200 can discourage you. However, you need to remember that dividend investing is about playing the long game. Dividend stocks will grow, they will pay you, and if you reinvest those dividends, they will increase further.

Investment Age

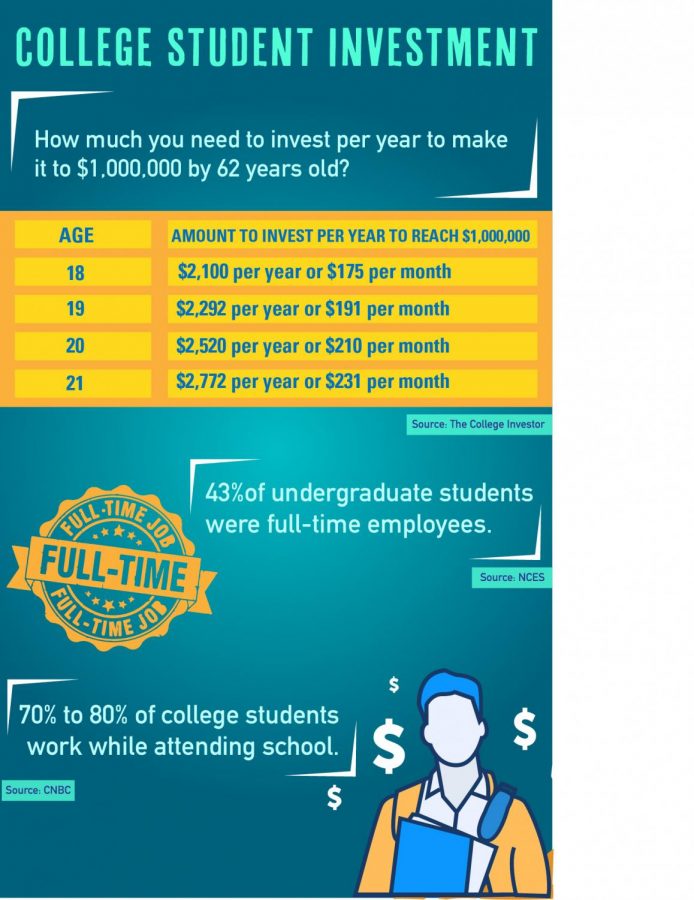

Amount needed to reach $1,000,000 by age 62. Check out the picture below.

You will see that if you start early, you can reach that goal. Investing at the age of 18 with only $2,100 per year will net you $1,000,000 by age 62. However, I suggest investing as much as you can per year to increase this and the amount of dividend income you can reinvest. You should have a minimum goal set for each year and increase this goal as you progress in life. Never go below the goal line unless it is an emergency as that takes priority. If there comes a year, you can invest more than the goal you set, do it.

Where to Open an Account

From when I started investing to now, technology has changed quite a bit. Now everyone has a smart phone and every brokerage firm has an app that allows you to access to the stock market anywhere. Today, there are dozens of places you can go and buy stocks. Many firms even offer cryptocurrency as an option.

We have a couple recommendations below

Robinhood

Robinhood is an excellent brokerage firm that gives you the option to open a trading account, roth ira, savings account and more. They even allow crypto trades. No fees or account minimums either. I use Robinhood for my crypto purchases.

Fidelity

I use Fidelity for dividend investing. I have a Roth IRA with them that I use for all my investments. I am working towards maxing this account out every year. They offer a wide variety of accounts and ways to invest. They recently began offering crypto as well. No fees to trade stocks and no account minimums.

What to Open?

Like every investor who is just beginning, you will need to open a brokerage account. I suggest opening up a Fidelity account as they have many features and services you can take advantage of. I also suggest opening up a RobinHood account so you can play around with fractional shares and cryptocurrency.

When you set up your Fidelity account, I suggest having a basic cash account that will allow you to buy any stock you want with the cash you have on hand. In addition, I suggest opening a Roth IRA account as this will be your main account. The Roth IRA account will give you many tax advantages. Click on the link above this sentence to learn more about this. Fidelity offers a bonus $100 when you deposit $50 into your Roth IRA account. Limited time offer however, so hurry up! Find out more HERE for the bonus offer.

Now What?

Once you open an account and fund it, you will need to invest it. This is where the patience and discipline come in. Now, before you invest, please understand you will lose money from time to time. This is a natural part of investing. There will be risks to everything you do but you can reduce these risks by the stocks you buy. Buying super safe stocks like Apple or Microsoft will give you peace of mind but will only net you a small profit each quarter. Buying stocks that offer more dividends but could fluctuate very high and low is a greater risk. Create a strategy that will work for you and will make you comfortable for the long road ahead. I myself have a moderately aggressive strategy.

Taking this into consideration, it you will want to begin your adventure by buying a mixed portfolio. I suggest the following.

- (JEPQ) | JPMORG. NASDAQ EQUITY PREM. INCOME ETF

- (RIV) | RIVERNORTH OPPORTUNITIES FUND INC

- (CLM) | CORNERSTONE STRATEGIC VALUE FUND INC

- (MO) | ALTRIA GROUP INC

- (O) | REALTY INCOME CORP

Fidelity and Robinhood offer free transactions on stocks. I suggest buying these with your Roth IRA first and maxing this out per year. You can put $6500 into your Roth IRA account each year. After you max your Roth account, then use your regular account to invest. This way, you can keep investing even after you are forced to stop with the Roth. Waiting for the next year to come around will waste time and money. Keep in mind, the regular account will come with taxes you will need to pay at the end of the year.

When asked to reinvest your dividends, always reinvest. Let your dividends work for you and get you more shares. I always reinvest my dividends, I never take them out.

I Did It! Now What?

Sit back and enjoy the ride. Keep investing as often as you can, set up a monthly transfer to help with this process and enjoy your earnings. Investing now and early will set you up for the future. In 50 years you will thank me for doing this and your kids will thank you for doing this for them.