Investing Newsletter – 1st Edition!

If you’re reading this, it means you’ve taken a chance on me, and I want to express my heartfelt gratitude. Your support means the world to me. As a small creator with big dreams, I’m dedicated to shining a light on financial literacy and helping others achieve financial freedom. Through this blog and my growing community, I aim to raise awareness and make a positive impact. Thank you for subscribing—your belief in my mission inspires me, and I’m excited to make you proud with this very first issue!

I’d love to hear your thoughts: was it too long? Too short? Would you like more details on certain topics? Your honest feedback is invaluable and will help me improve. Keep in mind however, this one will be longer than future ones as I am catching everyone up on my journey. If you enjoyed it, don’t forget to share it with friends who might benefit and encourage them to subscribe. All my socials are at the bottom. Thank you again for subbing!

Portfolio Progress

It is currently the end of January of the new year. For this year, I have made it my goal to clear the last remaining debt I have, max out my Roth IRA and buy a house. I think these are all doable. First things first, I put $1,500 towards my debt, $300 towards my Roth and my wife has put $1,000 Towards our savings for a house. I have roughly $30k in debt, the majority of which is medical debt from a hospital visit two years ago and surgery my wife needed this year on her foot.

I plan to use my bonuses at work that I get each quarter to help further pay down this debt and add to savings for a house. In addition, my tax return will be used for this as well. This is how I plan to reduce my debt or eliminate it this year.

I have begun my route to consolidation; I want to limit how many positions I have as it is becoming too much to keep track of and research. The stocks in green I added with the stocks I sold in beige. I also did this because my brother and sister sort of mimic what I do. They trust me and my decisions, so I want to make sure it’s a good portfolio. I had 24 positions and a goal of 18, which I met at the beginning of January. I am still however considering shrinking this further and going down to 15 positions.

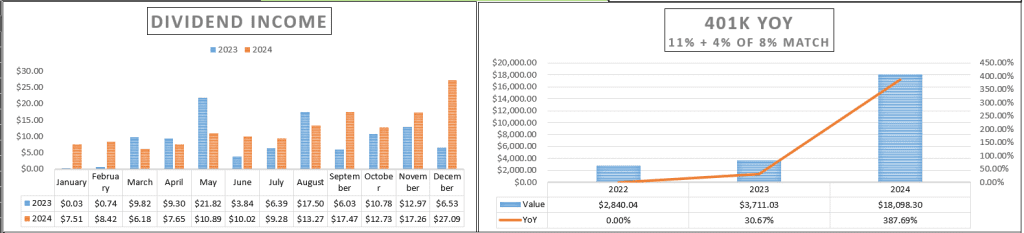

My current estimated yearly dividend income is $347.26. My goal is to raise this to $750 by next year, a significant challenge, but one I believe is achievable. By the time I retire, my dividends are projected to provide about $2,000 in monthly income. However, my ambition is to double that to $4,000 per month, creating an even stronger financial cushion. To help speed this along I am adding to FEPI and BITO for high dividends and using the money I get each month to put into other stocks.

Currently, my dividend income is up 39.74% YoY. I hope to double this by the end of this year.

When reviewing my 401(k), the projections estimate I’ll have just under $5,000 a month in retirement income based on my current contribution rate of 11%. However, I plan to increase this to 15% by April, with a long-term goal of reaching 18%-20%. At the current 11% contribution rate, my 401(k) balance is projected to grow to $707,988.84 by retirement—not including compounding, which will significantly increase this total.

On top of my 401(k), my dividend portfolio is estimated to add an additional $183,691.00 to my overall net worth, generating approximately $2,000 a month in dividend income. This combination should provide a solid financial foundation for retirement, especially as I plan to develop additional revenue streams before then.

You may notice my 401(k) balance is relatively low for my age. During the COVID-19 pandemic, I had to dip into it just to make ends meet. That’s not an exaggeration—I depleted all of it and accumulated significant credit card debt to stay afloat. Thankfully, I’ve been rebuilding and expect to be completely debt-free end of this year. I was able to chip away at enough debt to where I could focus on my 401(K) and added $18k in 2024.

Into The New Year!

As we kick off the year, it’s a great time to explore the exciting possibilities that 2025 has to offer. There are a couple of key factors that could drive growth and shape the market this year. Let’s dive into what could lie ahead!

S&P 500 Growth

- Analysts project a continued upward trend in the S&P 500, with estimates suggesting growth of 8-10%. Major drivers include strong earnings growth in technology, healthcare, and consumer sectors, along with resilience in consumer spending and potential easing of monetary policies. Some forecasts set targets for the S&P 500 to reach between 6,500 and 7,000 by the end of the year. With Trump in office, the market is expected to gain a nice boost. His Tariffs are scaring investors, but some analysts are suggesting this could pay off in the end.

AI and Technology Investment

- Massive investments in artificial intelligence (AI) are expected to influence markets significantly. Companies like Alphabet, Microsoft, Amazon, and Meta are set to drive substantial growth, with AI-related spending projected to exceed $1 trillion, creating ripple effects across industries. AI is quickly becoming the future for many businesses, and the companies mentioned above are aiming for the top spot when it comes to AI tech. Elon Musk’s AI robot is already gaining widespread attention.

While the overall market outlook for 2025 remains positive, there are still risks, such as inflationary pressures, geopolitical uncertainties, and concerns about high valuations in certain sectors. However, I’m optimistic about the year ahead for investors. Many could see significant growth in their portfolios as we move through the months. A key factor to watch will be if President Trump can push through policy changes that positively impact personal income, such as reducing or eliminating the federal income tax. Personally, this would mean an extra $15,000 annually, which could have a major impact on my investing and 401K contributions.

Crypto Trends: 2025

Bitcoin has recently surpassed the $100,000 mark, however, falling back down to $97k and then to $100k. It has been jumping back n forth. The jump in price was driven by favorable regulatory prospects under the Trump administration and favorable earnings from banking institutions. Analysts project that Bitcoin could reach between $150,000 and $225,000 by the end of 2025. I am a bit skeptical on this and will project $150k-$175k by the end of the year, nothing more than that.

| Now, this is news I thought would never happen. A TRUMP coin appeared right before President Donald Trump took office. The coin made a huge jump to $72.20 but fell back down to $38.70 and continues to hover around this mark. President Trump’s wife also released a coin which result in Trump’s coin taking a hit. Her coin hit a high of $13.64 but fell down to $4.41. It continues to hover around this price. I personally believe these coins will be a pump and dump and discourage anyone from investing in it. However, I am no financial advisor so invest in what you want, this is my personal opinion. |

| In addition, with Trump’s threat of tariffs on Mexico and Canada, crypto as well as the stock market took a bit of a dip. However, the fears surrounding this seem to be fading and we are seeing a rise again in both markets. I would hold and not panic sell but this is my personal opinion, please keep that in mind. |

If you love crypto and are looking into nabbing some, here are some to watch out. We have Ethereum (ETH), Solana (SOL), XRP (Ripple), Cardano (ADA), and Dogecoin (DOGE). XRP is on my radar and one I think with the biggest potential. You’ll notice Doge in the list and that is because they are trying to gain more credibility and more availability in terms of use in transactions. Given time, I can see this crypto reaching $1-$2 but only if they can gain access to consumer products.

Advice for New Investors

I want to leave you with something to reflect on. Too often, we talk ourselves out of our dreams and goals because we feel unworthy of them. But let me tell you—you do deserve them.

If you’re new to investing, it can feel overwhelming and even intimidating. You’re putting your hard-earned money on the line, hoping it will grow. And while it takes courage, I promise you it’s worth it. Dividend investing is an excellent way to start. Look for quality companies—resources like the Dividend Kings and Aristocrats lists can guide you to some of the best. They’ve stood the test of time and can help you build a strong portfolio.

If you’re unsure where to begin, consider starting with VOO, a fund that tracks the S&P 500. It’s a reliable, diversified choice to serve as a foundation while you learn more about investing and expand your strategy.

Now, onto something deeper—some advice that’s stayed with me. Matthew McConaughey said it best: Give yourself someone to chase. And that someone should be you. Instead of comparing yourself to others, which only leads to frustration and sadness, focus on becoming a better version of yourself. Chase your own growth, because that’s a journey that never leads to heartbreak.

Take McConaughey’s words to heart and let them inspire you to keep moving forward—both in life and investing.

| “And to my hero, that’s who I chase. Now when I was 15 years old, I had a very important person in my life come to me and say, ‘Who’s your hero?’ And I said, ‘I don’t know. I got to think about that. Give me a couple of weeks.’ I come back two weeks later – this person comes up and says, ‘Who’s your hero?’ I said, ‘I thought about it. You know who it is?’ I said, ‘It’s me in 10 years.’ So, I turned 25. Ten years later, that same person comes to me and goes, ‘So, are you a hero?’ And I was like, ‘Not even close’. No, no, no.’ She said, ‘Why?’ I said, ‘Because my hero’s me at 35.’ So, you see, every day, every week, every month, and every year of my life, my hero’s always 10 years away. I’m never going to be my hero. I’m not going to attain that. I know I’m not, and that’s just fine with me because that keeps me with somebody to keep on chasing. So, to any of us, whatever those things are, whatever it is we look up to, whatever it is we look forward to, and whoever it is we’re chasing – to that, I say, ‘Amen.’ To that, I say, ‘Alright, alright, alright.’ To that, I say, ‘Just keep living.’ ” – Matthew McConaughey |

Financial Education Community on X

Signup and help make a change in schools. The goal of this community is to share our knowledge and insights and eventually use our following to get petitions heard. We need to teach the younger generation about the basics of finance.

Join Here: https://x.com/i/communities/1869127781206139041

✨ Here’s where you can find me: ✨

- Website: www.RomesBlog.net

- Newsletter: romesblog.beehiiv.com

- X: @RomesBlog

- Threads: @RomesBlog

- Instagram: @RomesBlog

- Facebook: @RomesBlog

- YouTube: @RomesBlog

- TikTok: @RomesBlog

- BlueSky: @RomesBlog.bsky.social

DISCLAIMER

This is not financial advice, just my personal opinion. Be sure to consult a licensed professional before making any significant financial decisions.