Is Johnson & Johnson a Good Stock?

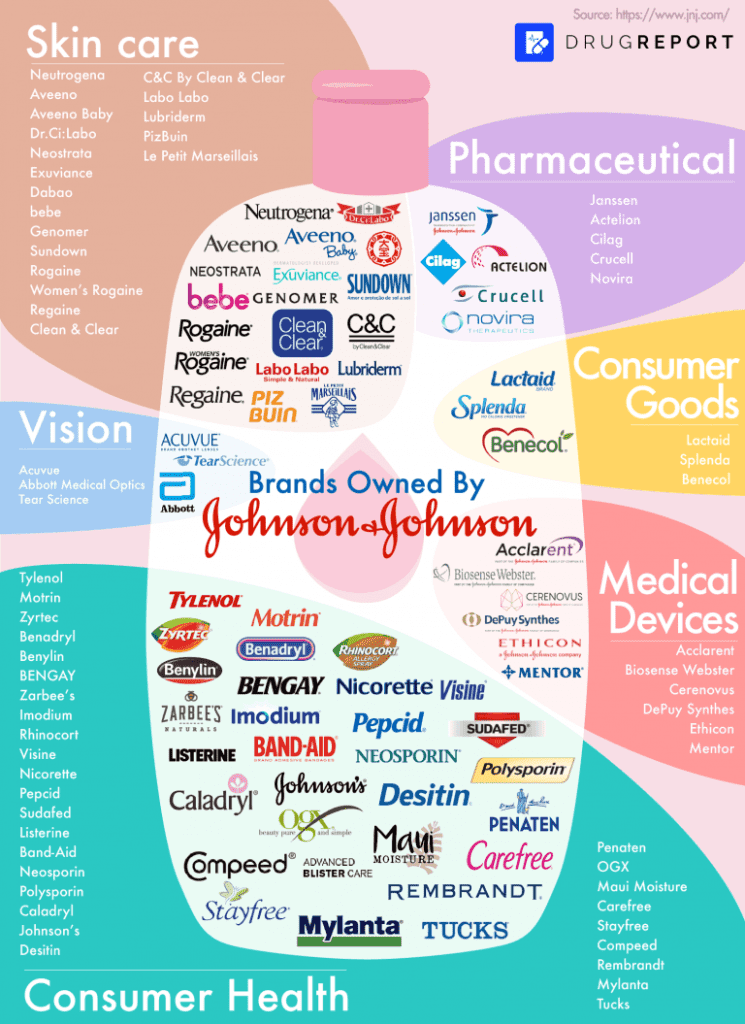

Ok folks, I got another healthcare stock that you will enjoy. These companies perform very well in any market climate. The topic of today’s article is Johnson & Johnson. Johnson & Johnson is a large multinational corporation with more than 275 subsidiaries, and operations in more than 60 countries. This means they cover everything from medicine to household products. However, Is Johnson & Johnson a Good Stock to buy?

Our Sponsor

Visit our friend to learn How Much Is a Million Pennies Worth

A Name You Can Trust: The J&J Legacy

Johnson & Johnson has been around since 1886. That’s over a century of making healthcare products that we often recognize. From Band-Aids to baby shampoo, J&J has built a reputation for quality. This brand trust can translate into steady sales, which is something investors love to see.

Due to their strong product presence, Johnson & Johnson can weather any storm that hits the global markets. When covid hit, their sales jumped because their products were in demand.

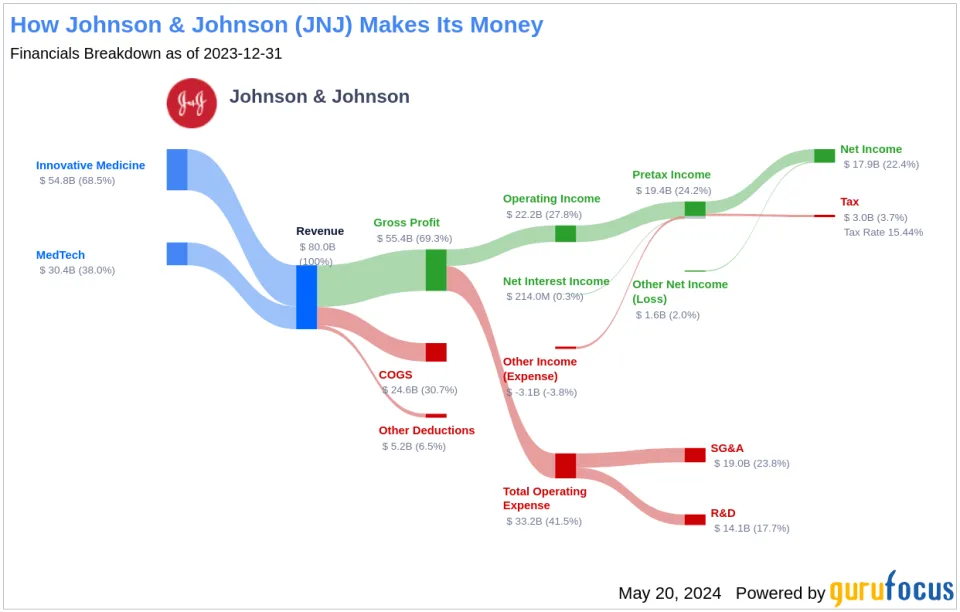

Strong Financial Performance: The Numbers Don’t Lie

J&J has consistently shown strong revenue growth over the years. In recent reports, J&J’s earnings have hit new highs, boosting investor confidence. A company that generates solid profits usually means it can weather tough times, and J&J has a history of just that.

Let us look at their revenue. As you can see, they have a steady increase in their revenue. They are close to hitting the $100 billion market and with their product range and new products they are developing, I can see them hitting this mark in the next 5 years.

- Johnson & Johnson revenue for the quarter ending June 30, 2024 was $22.447B, a 4.31% increase year-over-year.

- Johnson & Johnson revenue for the twelve months ending June 30, 2024 was $86.576B, a 15.5% increase year-over-year.

- Johnson & Johnson annual revenue for 2023 was $85.159B, a 6.46% increase from 2022.

- Johnson & Johnson annual revenue for 2022 was $79.99B, a 1.59% increase from 2021.

- Johnson & Johnson annual revenue for 2021 was $78.74B, a 4.65% decline from 2020.

Revenue can tell you how much a company makes, but their profits tell you how healthy the company is. As you can see, the company operates with a steady profit margin. This means they have the cash they need to develop products and medicines and improve on existing ones. This also means that they can pay their dividends to investors and increase those dividends over time.

- Johnson & Johnson gross profit for the quarter ending June 30, 2024 was $15.578B, a 3.46% increase year-over-year.

- Johnson & Johnson gross profit for the twelve months ending June 30, 2024 was $59.792B, a 13.39% increase year-over-year.

- Johnson & Johnson annual gross profit for 2023 was $58.606B, a 5.8% increase from 2022.

- Johnson & Johnson annual gross profit for 2022 was $55.394B, a 0.1% increase from 2021.

- Johnson & Johnson annual gross profit for 2021 was $55.338B, a 2.18% increase from 2020

The Challenge of Legal Issues: A Cloud on the Horizon

However, J&J isn’t without problems. The company has faced lawsuits related to its talcum powder products and more. These legal battles can create uncertainty and may affect stock prices. Investors need to keep an eye on these developments. It’s a bit like sailing a ship; you must watch out for storms that could rock the boat.

These legal troubles have caused their share price to drop a bit, which in my mind makes the stock even more of a buy. Their financial health is solid even with the lawsuits. Once their troubles are sorted, their share price will jump a bit. I have been adding J&J to my portfolio.

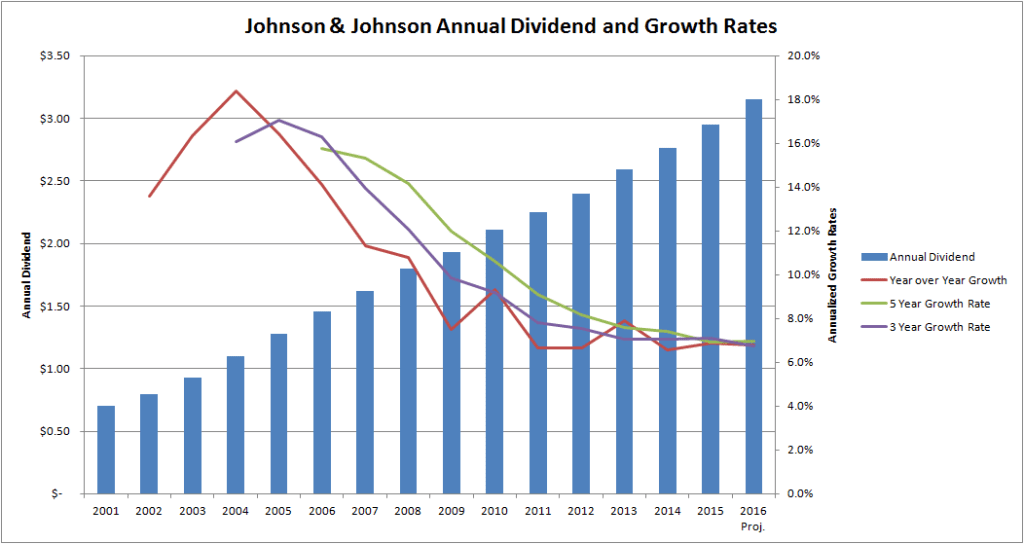

Dividends: A Sweet Incentive

Johnson & Johnson offers a very sweet dividend. They have been paying dividends since 1995, which makes this company a strong dividend player. Anyone looking for companies that pay out and grow their dividends over time, needs to look at J&J. Currently, the dividend yield is 3.11%, which pays out an annual dividend of $4.96. Their P/E ratio sits at 11.54 which is pretty good for a healthcare company.

Future Growth Potential: What’s Next?

The healthcare industry is changing, with innovations happening all the time. J&J invests heavily in research and development. This could lead to new products and treatments, which might drive future profits. If J&J continues to adapt and innovate, it could line its pockets even more.

While J&J is a giant, it’s not alone. Other healthcare companies are also vying for market share. Keeping an eye on competitors can give you insight into J&J’s future. If rivals outperform, it could put pressure on J&J. It’s like a race: if you’re not keeping pace, someone else might pull ahead.

Is it a Buy?

For me, yes. I believe J&J to be a company every investor should have in their portfolio. It is a solid company with solid financials. If you want a solid dividend stock for your portfolio, J&J is it.

Related Posts

DISCLAIMER

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial. Consult a financial advisor if you are unsure how to proceed further.