Is PepsiCo a Good Stock to Buy?

PepsiCo – A Brief Overview

PepsiCo, a global leader in the food and beverage industry, is known for its iconic brands like Pepsi, Lay’s, Gatorade, and Tropicana. With a rich history spanning decades, PepsiCo has established a strong presence in the market. They continue to develop, acquire and expand their presence.

PepsiCo owns more than 500 brands. This staggering amount gives them the ability to capitalize on the food market share. This means PepsiCo can gain traction when it comes to chips, snacks, soft drinks, bottled water, in-home products and more. PepsiCo’s product portfolio includes a wide range of enjoyable foods and beverages, including many iconic brands that generate more than $1 billion each in estimated annual retail sales.

Financial Performance

Analyzing PepsiCo’s financial performance is crucial in determining its viability as an investment. Over the years, PepsiCo has demonstrated consistent revenue growth and profitability, reflecting its strong business model and market position.

- PepsiCo revenue for the twelve months ending March 31, 2024 was $91.875B, a 4.36% increase year-over-year.

- PepsiCo annual revenue for 2023 was $91.471B, a 5.88% increase from 2022.

- PepsiCo annual revenue for 2022 was $86.392B, a 8.7% increase from 2021.

- PepsiCo annual revenue for 2021 was $79.474B, a 12.93% increase from 2020.

Stock Performance

Investors often look at a company’s stock performance to gauge its potential. PepsiCo’s stock has shown resilience and stability, offering investors a reliable choice for long-term growth. By considering factors like dividend yield and earnings per share, one can assess the attractiveness of PepsiCo’s stock.

As you can see, the company’s stock has grown tremendously. I believe as Pepsi expands their product base and continues their acquisition of other brands, their share price will continue to rise. It should also be said that America’s love for junk food will continue to fuel the company’s revenue and in-turn, their share price as well.

Dividend Trends

Understanding market trends is essential in predicting future stock performance. PepsiCo has adapted to changing consumer preferences by introducing healthier product options and expanding its presence in emerging markets. This strategic approach positions PepsiCo well for sustained growth.

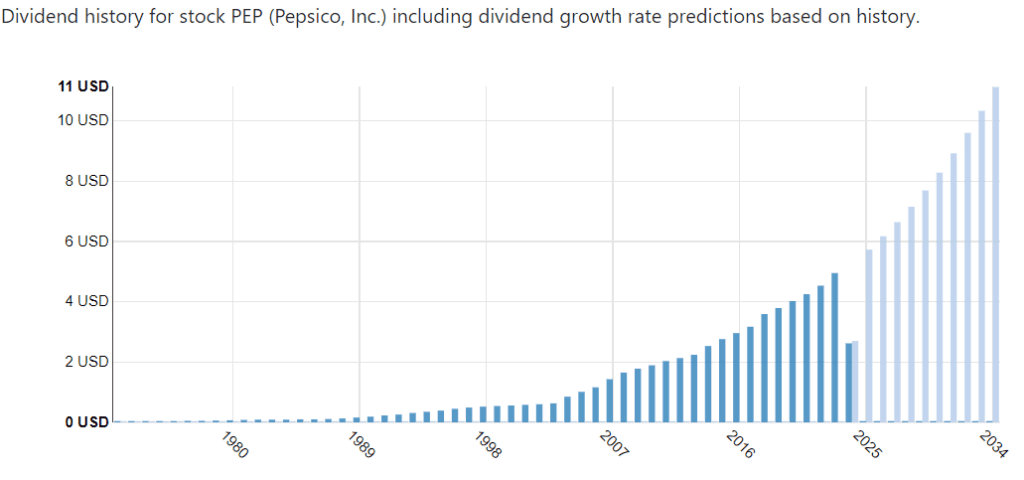

Because of their continued growth and development, this has led to PepsiCo consistently raising their dividends throughout the years. And the graph below shows what it could be in the future if the trend continues. The company’s current dividend yield is 3.02%, which pays out $1.35 per share.

Conclusion

In conclusion, Is PepsiCo a Good Stock to Buy? The answer is yes! PepsiCo emerges as a compelling choice for any investor seeking a stable and profitable stock. With strong financial performance, a history of innovation, and a solid market position, PepsiCo presents a promising investment opportunity for those looking to diversify their portfolio. I love their products and I love what they give me each quarter. I plan to keep adding to position and hold it for the long-term.