Mastering Your Money: Understanding the 40/30/20/10 Rule

Are you struggling with managing your finances? Managing money can feel like juggling. It’s tough to keep everything in the air. Budgeting is the number one reason people can save and reduce their debt. Currently, the average American owes $103,358 in consumer debt in the second quarter of 2024. This is across mortgages, auto loans, student loans, and credit cards. That is not chump change either.

You might be asking yourself, “Dave, how do I fix my current situation?”. The answer, follow the 40/30/20/10 rule. It is a simple budgeting hack that you and everyone else can use to become financially free. Let me break it down in a way that’s easy to grasp.

Our Sponsor

Visit our friend to learn about Debt Reduction Tools and Resources.

What is the 40-30-20-10 Rule?

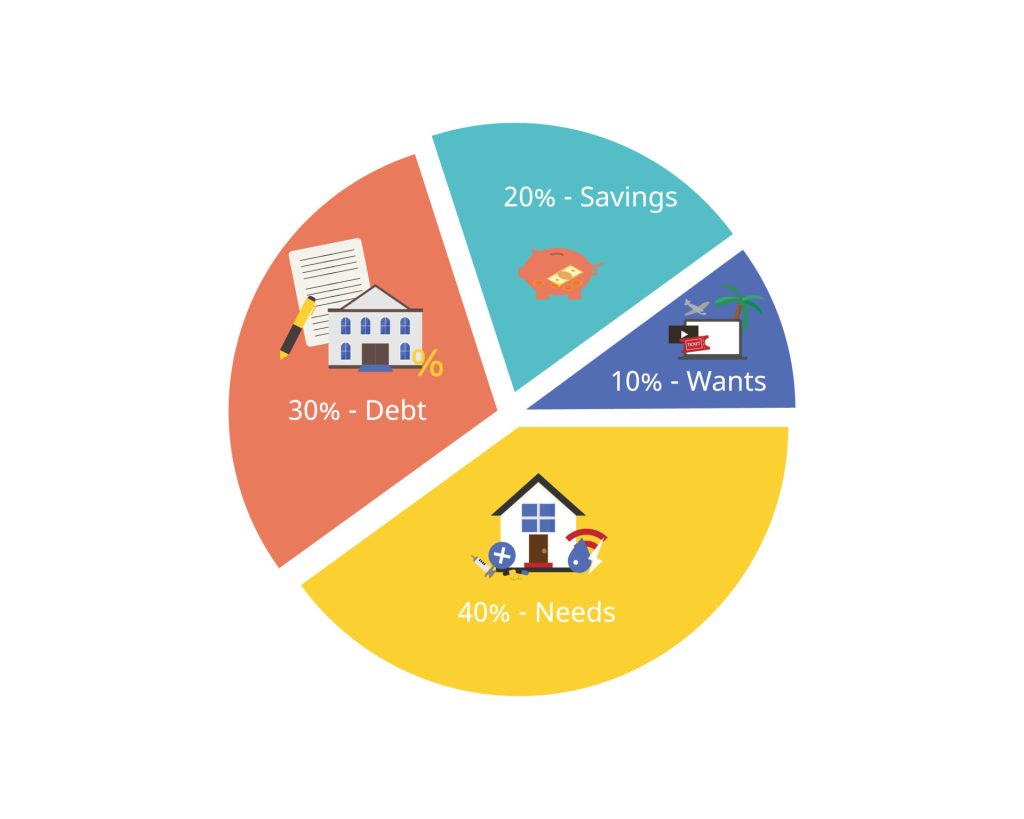

At its core, the 40-30-20-10 Rule divides your income into four clear categories. This budgeting method helps to give you a balanced view of your financial life. However, some people will differ on how it should be broken down. For example, one person might want 10% for debt repayment while another would want 30% for debt repayment. I would choose 30% to go towards debt. The faster you are debt free the faster you can focus on other stuff and be financially free sooner. You should this rule to help create an Emergency Fund. We have an article that discusses what this and can be found on our site.

Here’s how it works:

- 40% for Needs: This covers your essential expenses. This includes rent, groceries, utilities, transportation, and health insurance. These are the items you can’t live without. You want to make sure everything in this category is secure and you have no issues.

- 30% for Debts: If you have any debts, this portion helps you chip away at them. Whether it’s credit cards or student loans, or your house payment. The faster you can chip away at your debt, the more money you will have down the road to use for investing, saving, repairs, emergency funds, etc.

- 20% for Savings: Savings are crucial for your financial future. This includes contributions to emergency funds, retirement accounts, or investments. It’s like planting seeds today to enjoy the fruits tomorrow. Investing should be a priority for you alongside saving. In 20-30 years, you could have $2,000 to $4,000 or more coming in each month from your investments. The good news is that you will not have to sell your stocks to earn that income. They will be tax free dividends that come from your Roth IRA account. $7,000 to max it out each year, or $583 a month.

- 10% for Wants: This is where you can enjoy life a bit. Think dining out, hobbies, vacations, and streaming services. I know this one might hurt a few of you, but sacrificing for a year or two to get your finances in order can be the difference of living paycheck to paycheck and living your best life. This percentage will grow once your debt has been chipped away. You’ll be able to enjoy life more later.

Why Use the 40-30-20-10 Rule?

So why should anyone care about this rule? Instead of getting lost in complicated spreadsheets, the ratio keeps things simple. This simple way of budgeting takes the guesswork out of it and makes it super easy to do. The number one reason people quit something new is the unknown. You look at the task in front of you and in your mind, you create a mountain you must climb. This is no mountain; it is a leisurely stroll through the park. That is how easy it is to do.

Real-Life Example: Putting It in Action

Imagine you earn $4,000 a month (after tax). According to the 40-30-20-10 Rule:

- Needs: $1,600 (40% for housing, groceries, etc.)

- Debts: $1,200 (30% to pay off loans)

- Savings: $800 (20% for savings accounts or investments)

- Wants: $400 (10% for entertainment, dining out)

By following these percentages, you create a helpful guideline that keeps you balanced. However, do not think you have to follow these percentages as they are. Everyone’s situation is different, and everyone’s finances are different. Adjust the percentages to match your situation and what you can comfortably do. The whole point of this is to make life easier, not harder.

Tips for Sticking to the Rule

Sticking to the 40-30-20-10 Rule isn’t just about math. There are a variety of ways to help you stick to your budget. There are even some online tools that can help you as well. Here are some practical tips:

- Track Your Spending: Use apps or a simple notebook to keep tabs on where your money goes. You can also create a spreadsheet to help organize your finances. There is a ton of free stuff online you can use to help manage your finances.

- Make Adjustments: Life happens. If you find you need more for one category, feel free to adjust your percentages a bit. Just make sure it adds up to 100%! Like I said before, this is meant to make your life easier, not harder. Adjust as much as you need to, to make your life easier.

- Review Regularly: Check your budget at least once a month. This helps you stay on track and make changes when necessary. This one is very important. If you are not checking your finances at least once a month, how are you going to manage it? You need to see where your money is going to understand how to stop wasteful spending.

If you do this, I guarantee you will see results within a few months. Your life will change dramatically, and you will see how starting now saved you later. Future you is depending on you to make the right choice, please do.

Related Posts

DISCLAIMER

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial. Consult a financial advisor if you are unsure how to proceed further.