Real Estate vs. REITs: Which One’s the Better Investment?

When it comes to investing, you’ve probably heard the saying, “Don’t put all your eggs in one basket.” However, what if there was a stock out there that would help spread your basket around? That would be a REIT. However, if owning a piece of land and churning it out to become a second income stream is more your speed, that is good too. So, the question is, Real Estate vs. REITs: Which One’s the Better Investment?

Let’s break it down.

Our Sponsor

Want to become a Thousanaire? Check out our friends on how to achieve this goal.

What’s Real Estate All About?

Owning real estate means you have a piece of property, like a house or a condo. When you own that property, you’re the boss. You can rent it out, live in it, or sell it later. Real estate often feels like a solid investment. It can appreciate over time, giving you a nice return when you sell. Plus, if you rent it out, that can provide a steady stream of income. The goal in life should be to have as many sources of income you can. This way you can enjoy life how it was meant to be enjoyed.

However, being a landlord isn’t all sunshine and rainbows. You have responsibilities, like maintenance, repairs, and dealing with tenants. Sometimes, those tenants might not pay on time, or worse, they might leave your place in bad shape. And if you are really unlucky, the tenant will stay in your building without paying and become protected by squatter’s rights. Owning a property involves more than just collecting rent checks, it requires a lot of time, effort and diligence on your part.

REITs: The Easier Way to Invest in Real Estate

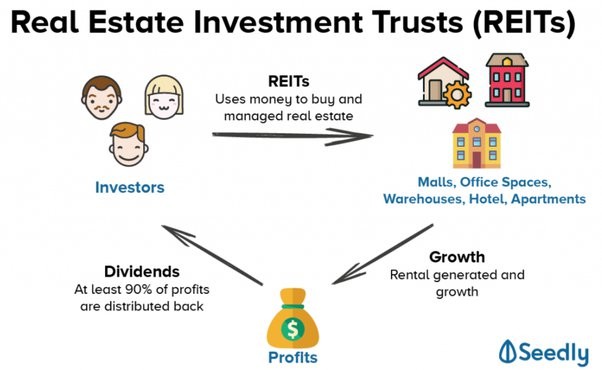

Now, let us talk about REITs. A REIT is like a big pot of money collected from different investors to buy and manage properties. When you buy a REIT stock, you’re not getting a piece of a physical property; instead, you’re investing in a company that owns and manages real estate. For example, VICI Properties owns 54 dynamic gaming destinations, 39 other experiential properties and four championship golf courses located across the United States and Canada. By owning this stock, you gain access to all of that.

Investing in REITs can be much simpler. You don’t have to worry about repairs or finding tenants. Plus, you can buy and sell REIT shares just like stocks, making it easier to cash out if you need to. The beauty of REITs is that they often pay dividends, giving you a regular income without the hassle of direct ownership. Some REIT’s pay monthly dividends while others pay quarterly.

The Cash Flow Comparison: Which Brings in More Money?

When it comes to cash flow, owning a rental property can provide a reliable income stream. Imagine getting that monthly rent check! But remember, your expenses—mortgage, property taxes, and maintenance—can eat into your profits. On the other hand, REITs typically provide dividends, which can be a great source of passive income. They’re also required to pay out a large portion of their income as dividends, which means you could be getting regular payouts without any of the headaches of property management.

Which One’s for You?

Choosing between owning real estate and investing in REITs truly depends on your style. Do you want to dive into property management and enjoy the hands-on experience? Or do you prefer a more passive approach, letting someone else manage the properties while you sit back and collect dividends?

If you’re looking for control, stability, and a tangible asset, owning real estate might be your jam. But if you want flexibility, liquidity, and less hassle, REITs could be the way to go. For myself, I plan to do both. Currently I own a few REITs such as NNN, VICI, ARR and ARB. This gives me access to a wide range of real estate without having to deal with the hassles of owning one. However, down the road I plan to become a landlord and use renting as a second income stream. This, combined with my investments and 401k later, my retirement will be set.

DISCLAIMER

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial. Consult a financial advisor if you are unsure how to proceed further.