Roth IRA vs Traditional IRA, Which One Is Better For Investing?

When it comes to dividend investing or simply retirement, you have many options to choose. It can be daunting seeing all those choices, unsure of which one to pick so I would like to help with that. I will show you two accounts that will help you on your investment journey. The account you pick will depend on you but for my own personal goals and preference I like the Roth IRA but I will let you decide.

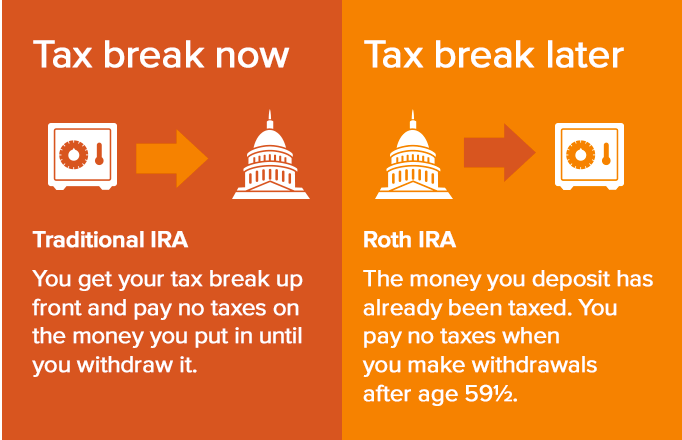

A traditional IRA helps you save money and will offer you a tax break right now. An example would be, if you contribute $4,000 to a traditional IRA in 2023, you might be able to deduct it from your tax return. This will give you a break on your IRS obligations while your investment grows, though, it subject to income limitations. There is an annual contribution limit of $6,500 for people under 50 and $7,500 for people over 50.

You can make penalty withdraws at 59 ½ and you will need to take withdraws by age 73. However, when you do take money out you will need to pay taxes on the deductible contributions you made and on investment gains.

A Roth IRA is different in that, this account is not designed to give you a tax break right now. If you contribute $4,000 in this account, it is after-tax money. The benefit of this is you have already paid taxes on the money you put in. When it is time to make withdrawals, all the growth in this account that you have built up is yours to keep. The annual contribution is the same as a traditional IRA with $6,500 for anyone under 50 and $7,500 for anyone over 50. Another benefit is there is no time restriction on this account. With a traditional IRA you need to withdraw by age 73, whereas in a Roth IRA you do not. You can leave the money in the account and pass it on in your estate planning.

How to check your IRA eligibility

To qualify for one of these accounts, you will need earn income. You or your spouse will need to have this when opening an account. To gain every benefit of these accounts you will need to make sure you meet the government’s requirements. Income thresholds very and depend on key factors – How much you will earn, you have a workplace retirement plan and your filing status.

An example would be, you file as a single or head of household in 2023 and you have a retirement plan at your job. You would need to earn less than $73,000 to enjoy the full deduction of a traditional IRA. For a Roth IRA in 2023, you need to earn less than $153,000 to enjoy its benefits.

How to choose the right IRA for you

For this segment, I suggest contacting a financial advisor. They can offer the best advice on which account will work best for you.

Traditional IRA: Pros and cons

Pros

- You can enjoy a tax break right now.

- Money grows tax free until withdrawal

Cons

- Pay taxes upon withdrawal.

- Pay taxes on account growth down the road.

- Required to take money out by age 73.

- Possible penalties for early withdrawal.

Roth IRA: Pros and cons

Pros

- Withdrawals are yours to keep because of after-tax dollar contributions.

- Use After-Tax dollars now, pay no taxes later.

- Growth in the account remains tax-free now and later.

- No early withdrawal fee or penalty.

- No age limit on how long you can keep money in the account.

Cons

- No upfront benefits since you need to use after-tax dollars.

- No tax benefits until later.

I hope this article helped you out and as always, consult a licensed professional. I am simply a man who loves to invest.