Should You Bet on Vici Properties?

When considering investments, the stock market can feel like a rollercoaster ride. One name that keeps popping up in conversations lately is Vici Properties. It is widely knowing as the gambling REIT due to its tenants. Some of these you will know right away, such tenants are Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas. They have 54 gaming properties! That is an insane number to have in Vegas. However, is Vici Properties a good stock to buy? Let’s take a closer look at what makes this company tick and whether it’s a wise choice for your portfolio.

Our Sponsor

Visit our friend to learn How Many Hours Do Millionaires Work

What is Vici Properties All About?

Vici Properties is a real estate investment trust (REIT) that specializes in gaming, hospitality, and entertainment properties. Think of it as a landlord for big-name casinos and resorts. Instead of just collecting rent from tenants, Vici owns the properties outright, allowing it to collect steady income from long-term leases. This structure is a bit like owning a piece of your favorite gaming destination without dealing with the day-to-day operations.

Here is a snippet from VICI’s website;

VICI Properties Inc. is an S&P 500® experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip. VICI Properties owns 93 experiential assets across a geographically diverse portfolio consisting of 54 gaming properties and 39 other experiential properties across the United States and Canada. The portfolio is comprised of approximately 127 million square feet and features approximately 60,300 hotel rooms and over 500 restaurants, bars, nightclubs and sportsbooks. – VICI Properties

Strong Revenue Streams

One of the most appealing aspects of Vici Properties is its impressive revenue model. The company has a diverse portfolio of properties including popular brands like Caesars Entertainment and MGM Resorts. This variety helps to cushion the impact of any downturns in one single area. When one property faces challenges, others can step in to maintain revenue.

Moreover, the gaming industry has shown resilience even during tough economic times. People enjoy their entertainment, and casinos provide that buzz. This steady demand translates to reliable cash flow for Vici, making it a potential solid investment choice.

Let us check out their revenue. As you can see, they steadily kept or increased their revenue each year. Proving they can keep tenants during these troubled times in the USA. They currently boast a 100% occupancy rate! That is amazing considering most landlords are struggling to keep tenants.

- VICI Properties revenue for the quarter ending March 31, 2024 was $0.951B, a 8.41% increase year-over-year.

- VICI Properties revenue for the twelve months ending March 31, 2024 was $3.686B, a 20.38% increase year-over-year.

- VICI Properties annual revenue for 2023 was $3.612B, a 38.89% increase from 2022.

- VICI Properties annual revenue for 2022 was $2.601B, a 72.28% increase from 2021.

- VICI Properties annual revenue for 2021 was $1.51B, a 23.17% increase from 2020.

Now, let us dive into their profits. They have strong revenues but if their profits are slim to none then it means nothing. However, that is not the case for VICI Properties. As you can see, they have amazing profit margins. This shows how well they manage their money and how they are able to continue paying a dividend and growing that dividend.

- VICI Properties gross profit for the quarter ending March 31, 2024 was $0.951B, a 8.41% increase year-over-year.

- VICI Properties gross profit for the twelve months ending March 31, 2024 was $3.686B, a 20.38% increase year-over-year.

- VICI Properties annual gross profit for 2023 was $3.612B, a 38.89% increase from 2022.

- VICI Properties annual gross profit for 2022 was $2.601B, a 72.28% increase from 2021.

- VICI Properties annual gross profit for 2021 was $1.51B, a 23.17% increase from 2020.

Healthy Dividend Yield

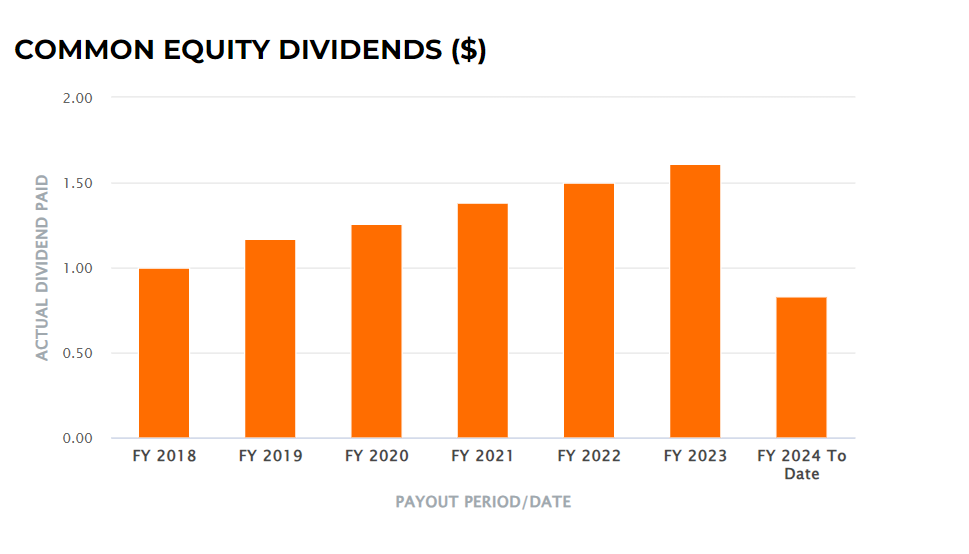

Investors often seek out stocks with satisfying dividends, and Vici Properties delivers. With a consistent dividend payout, Vici offers a tempting yield that can be appealing for those looking to earn passive income. VICI currently boasts a growing dividend yield that has increased each year. They began paying a dividend in 2018 and since then has never missed a payment. VICI is currently trading at $31.61 a share with a dividend yield of 5.28%.

Growth Potential in the Gaming Sector

As the gaming and entertainment industry continues to expand, Vici Properties stands to benefit significantly. New markets are emerging, and regulations are loosening in many areas, leading to increased opportunities for casinos and resorts. This growth can translate into higher rental income for Vici, which is a positive sign for potential investors.

Imagine investing in an upward spiral where the gaming industry keeps growing—your investment could grow along with it! If you do not believe me, check out the chart below. It shows how over the last 5 years, VICI’s share price has remained high and continues on an upward trend. As Las Vegas continues to expand and garner more gaming and hospitality businesses, its wealth will continue to rise.

Is It a Buy?

I currently own shares of VICI and plan to keep increasing my share count for the foreseeable future. I believe this stock to be a long-term hold and hope to obtain at minimum, 350 shares. With this amount, it should net me $570 a year in dividend income. With its 100% occupancy rate, rising revenue and share price, it is a no brainer for me. One step closer to financial freedom.

Related Posts

DISCLAIMER

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial. Consult a financial advisor if you are unsure how to proceed further.