Understanding Capital Gains Tax: A Simple Guide for Everyone

Taxes are the scourge of the earth. They are everywhere and pretty much cover everything we own or will own. It is hard to escape, you buy a TV and notice there is an added $20-$30 on the total price, that is the government trying to take a little more from you. It is amazing how you pay taxes on your income, taxes on things you buy, taxes on things you sell and taxes on things you live in or use. I hate to break it to you, but investing is no different. Government takes their taxes from you in the form of a Capital Gains Tax.

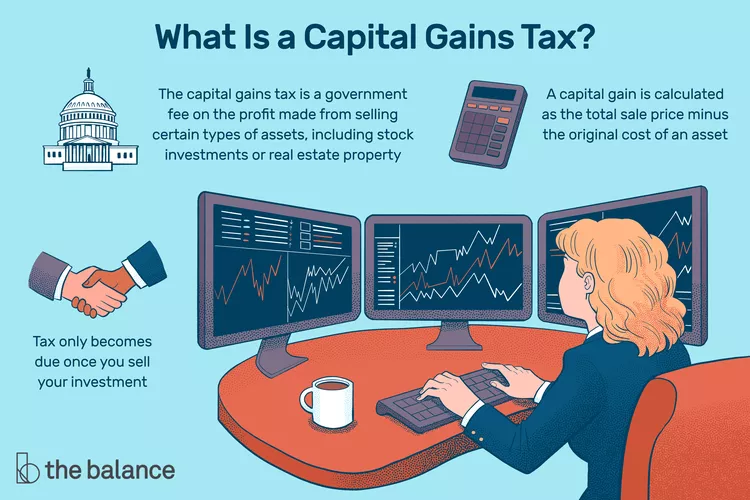

What Exactly is Capital Gains Tax?

Capital gains tax is a tax you pay on the money you make when you sell a capital asset for more than you paid for it. Think of it like this: if you buy a painting for $100 and later sell it for $300, you’ve made a profit of $200. That profit is your capital gain, and the government wants a slice of it in the form of tax. It’s a pretty straightforward concept when you look at the numbers.

Different Types of Capital Gains

Capital gains aren’t all treated the same. There are two main types: short-term and long-term.

- Short-term Capital Gains

- Short-term gains happen when you sell an asset you’ve held for a year or less. Typically, these gains are taxed at your regular income tax rate. That means if your regular income tax rate is 25%, your short-term capital gains will also be taxed at 25%. It’s like getting a double whammy on your earnings.

- Long-term Capital Gains

- On the other hand, long-term gains occur when you hold onto an asset for more than a year before selling. These are usually taxed at lower rates, which can be a big relief. The long-term capital gains tax rates are generally 0%, 15%, or 20%, depending on your income level. It’s almost like a reward for being patient!

Example of Capital Gains Tax

Understanding capital gains tax isn’t just for tax pros or accountants. It’s essential for anyone who buys, sells, or invests in assets. I would hate for anyone to get stuck with a hefty tax bill at the end of the year because they did not plan accordingly. The government will want their slice of the pie, always remember that. If you want to avoid this, open a ROTH IRA and use that to invest.

Let us say you sold stock in company A for $2,000 profit, you also sold stock in company B for a $500 loss. Your total taxable gain would be:

- $2,000 – $500 = $1,500

Your tax rate will depend on how long you owned each stock:

- Stocks owned less than one year will be taxed at your ordinary income tax rate.

- Stocks owned for one year or more will be taxed at what is called a Long-term Capital Gains Rate. This is 15%

| Tax Rates | ||

| Rate | Single | Married |

| 0% | $0-$41k | $0-$83k |

| 15% | $41k-$445k | $83k-$501k |

| 20% | $445k+ | $501k+ |

Using the example above and let us say you owned them for one year or more, you can calculate the rate as follows:

- $1,500 x 15% = $225 in taxes.

What About Losses?

Here’s a twist that many people forget: capital gains tax can work in your favor if you have losses. If you sell an asset for less than you paid, that loss can offset your gains during tax season. It’s like balance scales; if you gain on one side, a loss on the other can help you out.

Planning Ahead

If you’re making investments, it’s wise to think about the tax implications. Knowing when to sell or hold onto an asset can make a real difference in how much you keep in your pocket after taxes. Imagine walking away from a sale, not just happy with your profit but also knowing you’ve minimized your tax hit. It’s a win-win!

Disclaimer

I am not a financial advisor or licensed stockbroker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial.