Understanding the New FICO Credit Score

Having a good credit score and set you up for an amazing future. Almost every major purchase revolves around your credit score and whether it is good or not. If you want to buy a home, a new car, RV, boat, motorcycle, land, a freaking island; you need good credit. This is why it is important to maintain a good score and work towards getting one if you do not have one or yours is not that great.

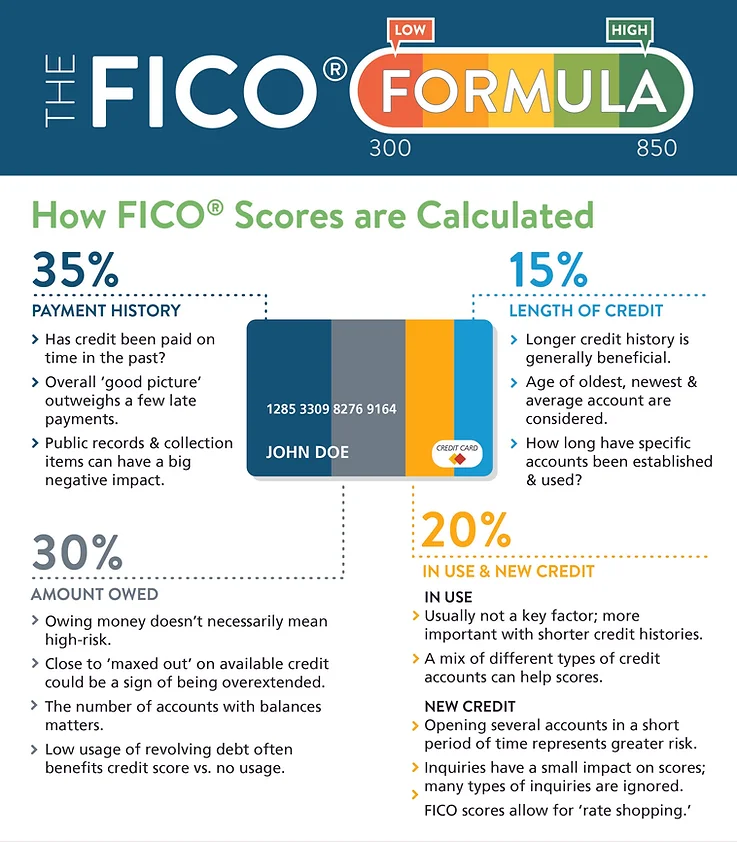

The FICO credit score was introduced by Fair Isaac Corporation in 1989 and has become a universal measure of a person’s creditworthiness. FICO scores is used in more than 25 countries and billions of people are affected by it. Financial institutions rely on FICO scores to tell them whether or not you are a liability. Banks and lenders will not give you money to buy something if your score shows that you are a risk. The higher the score, the more attractive you become to lenders.

However, since its inception, the algorithm and calculations used to determine your score have evolved. More and more data is becoming available in today’s technological age. A persons debt, income, spending habits, everything is becoming readily accessible to FICO.

What is A Good Credit Score?

The average FICO score is 704. However, you will want to be at 750 or above, preferably 800 or above. The higher the score the better your chances of being approved for a loan with a low interest rate. There are ways you can improve your credit score or getting out of debt if you happened to overspend in your cards.

A Boost for average Credit Scores

If you are worried about your score or looking to increase it, there is good news. You can receive a boost to your score with something called “UltraFICO”. It is meant to allow people without good credit to receive extra points based on what they call, “Indicators of responsible financial behavior.” This came out in 2019.

If you have a credit score between 500 to 600 range, you could receive an increase of 20 points or more. To benefit from this, you must do the following:

- Save Your Cash. Having consistent money in your checking and savings accounts can help you get a higher score. Having at least $500 in savings with no negative balances for three months will help increase your score.

- Keep Your Bank. Maintaining a long-term bank account can help show companies a degree of financial stability.

- Pay Your Bills on Time. Although paying a bill a few days late might not adversely affect your credit score, paying on time will now definitely help boost it.

- Avoid Negative Balances: If you do not overdraw your bank account, you will be demonstrating that you are responsible and able to handle the benefits of having more credit offers.

Another way to improve your credit score is by having more credit that you are using. Having a low utilization ratio with a high amount of credit shows, you are responsible. If you see a boost in your credit score due to UltraFiCO, remember that your score could also change quickly if you immediately use your new score to get a new credit account and max it out. Remember to be responsible and spend wisely. It is very easy to overspend and debt can happen in a blink of an eye.