What Is a Mutual Fund and Are They Worth It?

You have probably heard the term mutual fund before and wondered how they work and if you should invest in them. I am more than happy to dive into this topic and explain it for you. I own three mutual funds myself; this should tell you that I believe in them. Though, as a disclaimer, please do your own research. I currently own the following; CLM, CRF and RIV.

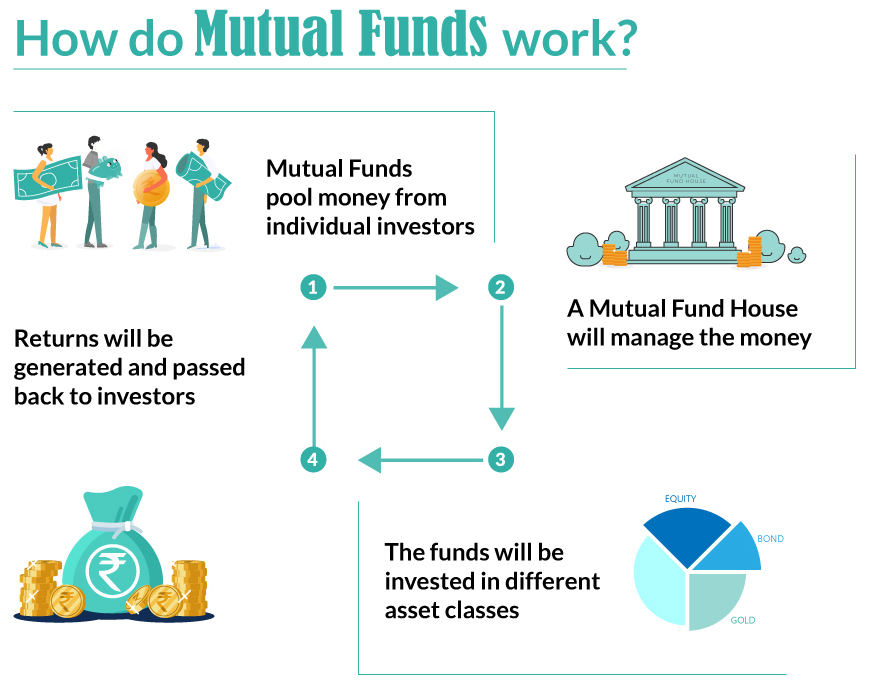

A mutual fund is a stock that pools money from many investors. They take the money from you and I and invest it in securities such as bonds, short-term debt and other stocks. The combined holdings make up the fund’s portfolio. You buy shares and each share represents your part ownership in the fund and the revenue it generates.

Why do people buy mutual funds?

People buy mutual funds for many different reasons. They enjoy that the funds are professional managed and fund managers do the research for you. The fund provides excellent diversification, which protects you if one or more companies fail. Then there is affordability and liquidity. Funds tend to be relatively cheap and depending on the performance of a fund, offer excellent liquidity in case you wish to sell in the future.

These funds provide many benefits to an investor and give you the option to diversify your portfolio without owning hundreds of different stocks. Buy from one fund and let them do the buying for you. However, I would still suggest buying stocks outside the fund that align with your goals.

What types of mutual funds are there?

The majority of funds out there fall into of one of four categories. You have your bond funds, target date funds, money market funds and stock funds. Each one has it pros and cons and should be thoroughly researched before buying.

- Bond funds – These funds tend to have a higher risk associated with them. Because of the high risks, they typically produce higher returns. Due to the variety of bonds, the risks and rewards will vary dramatically and should be researched.

- Target date funds – This fund will hold a variety of bonds, stocks and other investments. Overtime, the percentage of each category in the fund will shift depending on the funds strategy. These funds are great for people with particular retirement dates.

- Money market fund – These funds are generally low risk and a good starter fund. The law requires them to invest in only high quality, short-term investments. U.S. Corporations, and federal, and state governments issue these.

- Stock funds – These are regular corporate stocks. Not every fund will be the same however. For example:

- Growth funds – These stocks pay dividends but have the generally see above-average gains.

- Income funds – invest in stocks that pay regular dividends.

- Index funds – track a particular market index such as the Standard & Poor’s 500 Index.

- Sector funds – specialize in a particular industry segment.

What are the benefits and risks of mutual funds?

Mutual funds offer you a diversified portfolio that is professional managed. In addition, the funds offer you a few ways to earn money:

Dividend Payments – What I specialize in and my favorite type of income, dividend! These funds offer you money to own them. If you are dividend investing like I am, this is a good selling point.

Capital Gains Distributions – A fund passes their earnings to you when they sell a security under their umbrella that has increased in price. This causes the fund to a have a capital gain. When the end of the year finally comes around, the fund will distribute these gains, minus any losses, back to you.

Increased NAV – If the value of the fund’s portfolio increases, this increases the value of the fund itself and its share price. Of course, this is after they factor in any expenses the fund incurred. The higher the NAV, the higher the value of your investment.

No matter if it is a fund, ETF, stock, etc…There is always a benefits and risks associated with them. With mutual funds, there is a possibility you could lose money you invested because the securities held by the fund go down in value. Your dividend payments could change as well if market conditions change.

When researching a fund, their past performance might not be as important and might not reflect a positive return in the future. However, past performance can show you how volatile or stable a fund has been and from there you can gauge how stable or volatile it could be in the future. The more stable a fund, generally will result in lower income earned, whereas the higher the risk, the higher the returns.

How to buy and sell mutual funds

You can buy mutual funds from any brokerage account such as Fidelity or Robinhood. You can also buy shares from the fund itself. I would suggest a brokerage account so you can easily manage your portfolio.

Funds are required to buy back shares if you decide to sell. They are considered “Redeemable” and any payments owed must be paid out within seven days.

Understanding fees

With any business, there are costs associated with running them. Mutual funds are no different; they will have running costs and generally pass this burden onto you, the investor. Fees and expenses will vary from fund to fund and are usually based on every $1,000 earned.

For example, if you invest $10,000 into a mutual fund with let us say an annualize return of 10% and an operating expense of 1.5%. After 20 years, you would have an estimated $50,000 dollars (give or take a few hundred.) Now, if you invest in a different fund with lower operating costs, such as 0.5%, then you would end up with an estimated $61,000 (give or take a few hundred.)

If you would like to compare, there are plenty of fund calculators out there that can give you an estimated return rate based on how much you wish to invest.