What is Dollar Cost Averaging?

Consistency is key when it comes to investing. Building this trait up in yourself is crucial if you want to succeed and have a nice retirement income later in life. One way to help build this up and achieve your goals would be something that is called Dollar Cost Averaging or DCA. This simply approach to investing can help you grow your portfolio without sacrificing your wallet. This term may sound confusing but I assure you it is not.

Our Sponsor

DCA is important to investing, it helps you build wealth without thinking about it. However, how do you teach kids to save and build for their future? Check out The Best Piggy Banks That Can Help Teach Kids Money Management Skills

What is Dollar Cost Averaging?

Dollar cost averaging (also referred to as DCA) allows investors to buy the same dollar amount of a stock, bond, mutual fund, ETF or other investment on a scale that works for them. The share price of a company or stock is not important when you use this approach. Dollar cost averaging has especially become popular with the newer generation of investors, those who do not have much available in terms of income.

With DCA, you do need thousands or millions of dollars to invest. You could invest $25 a month and you would be dollar cost averaging. You can start growing your portfolio on a regular basis – you can simply contribute whatever you can afford as your income level rises.

I like to use this example when I explain this process; think of it like filling up your gas tank. Instead of waiting for prices to drop (which might never happen), you just fill up a little each week. Over time, you buy more gas when prices are low and less when prices are high. This smooths out the cost and can help protect you from market volatility.

How Does Dollar Cost Averaging Work?

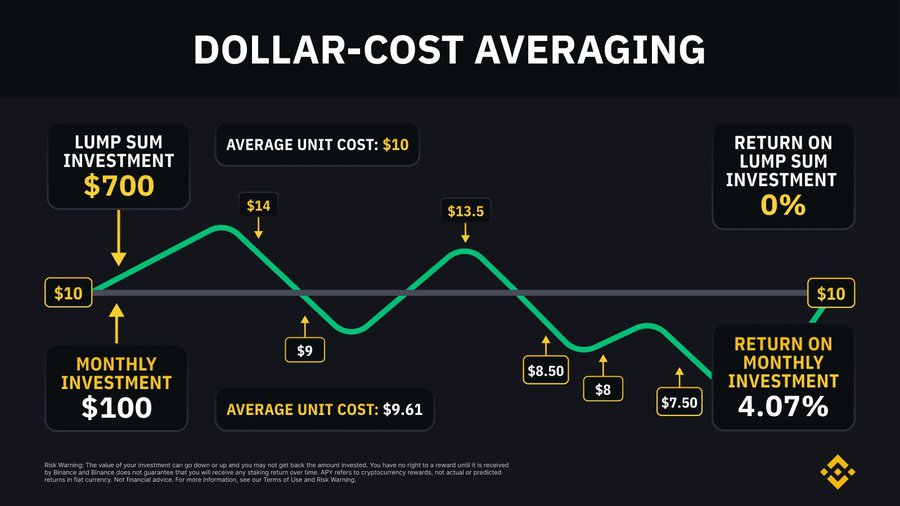

Dollar-cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period of time, regardless of price. By using dollar-cost averaging, investors may lower their average cost per share and reduce the impact of volatility on their portfolios. In effect, this strategy eliminates the effort required to attempt to time the market to buy at the best prices. Credits to – Investopedia

To dumb it down a bit more, imagine you decide to invest $100 every month in a stock. In one month, the stock price is $10, meaning you buy 10 shares. The next month, the price rises to $20, so you buy 5 shares. The month after that, the price drops back to $15, and you buy 6.67 shares. By the end of three months, you’re not just betting on one price point. Instead, you’ve averaged your costs over three different prices. This strategy helps you avoid timing the market, which can be risky and stressful.

The Benefits of Dollar Cost Averaging

- Reduces Emotional Stress

- Investing can stir up a lot of feelings. The ups and downs can make anyone anxious. DCA helps to take the emotion out of investing. Since you’re investing consistently, you don’t have to worry about whether now is the “right” time to buy.

- Builds a Habit of Investing

- Like any good habit, consistency is key. By investing regularly, you develop a routine. Over time, it becomes second nature. Just like brushing your teeth, you won’t skip it because it’s part of your daily life.

- Reduces Impact of Market Volatility

- Markets can be unpredictable. One day, stocks are soaring; the next, they’re plummeting. With DCA, you’re not putting all your money in at once, which lessens the impact of short-term market swings. You’re buying regardless of the price, which means some of your shares will be at lower prices.

Is Dollar Cost Averaging Ideal for Your Portfolio?

Dollar Cost Averaging is a straightforward strategy that can ease the stress of investing. It promotes discipline and consistency while helping you manage the rollercoaster of market prices. Just remember, every investment choice has its own pros and cons. It’s all about what fits best with your goals and what makes you feel comfortable. So, are you ready to consider DCA as part of your investing journey?

Disclaimer

I am not a financial advisor or licensed stock broker. This is my opinion. It’s essential to consider that no investment is without risks. As with any investment decision, thorough research and consideration of your financial goals and risk tolerance are crucial.